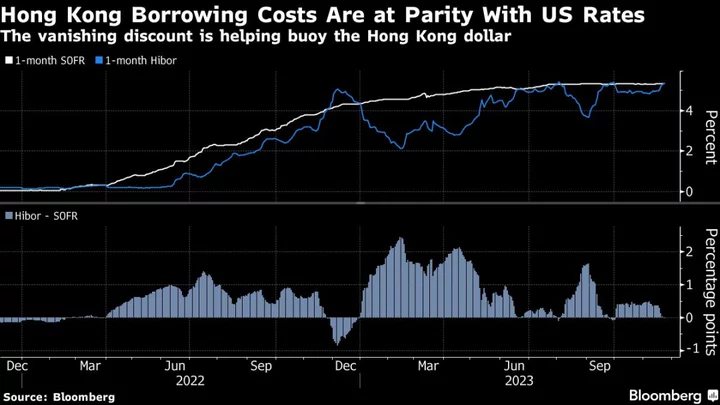

A rally in the Hong Kong dollar that saw it touch the strongest level this year against the greenback is likely to continue due to a seasonal liquidity squeeze.

The currency has climbed 0.4% this month, set for its best gain since July, after rising to as high as 7.7895 per dollar on Tuesday.

Fueling the rally are bets that funding costs will remain elevated versus interest rates on the greenback, as local lenders hoard cash for year-end regulatory checks. That makes the so-called carry trade of selling the Hong Kong dollar against American assets unprofitable, forcing short-sellers to stop losses and quickening the advance.

The one-month interbank cost of borrowing in Hong Kong has climbed to almost 5.4%, approaching its highest level since 2007 and erasing a discount to its US equivalent. At the start of this month, the US borrowing cost was 0.45 percentage points higher.

“We expect the liquidity to stay tight at least until January, before gradually easing in the following months,” said Cindy Keung, an economist at OCBC Bank (Hong Kong) Ltd., who predicts the currency will strengthen toward 7.75 before weakening past 7.8 again.

Pegged to the U.S. dollar since 1983, the Hong Kong dollar is allowed to trade in a band of 7.75 to 7.85 against the greenback. The de-facto central bank was forced to defend the peg on multiple occasions in the past two years, shrinking the city’s liquidity pool. The aggregate balance has fallen by about 90% since its 2021 high.

As a small and open economy, Hong Kong is especially vulnerable to money flowing in and out. The city uses the linked exchange-rate system to manage monetary policy and prevent local borrowing costs from diverging too much from US rates. The frequent divergence of the city’s economic conditions from those of the US has prompted wagers that the peg will break.