Hedge funds are turning ever more negative on the euro ahead of an interest-rate decision by the European Central Bank next week that is proving increasingly difficult to call.

They’ve dumped nearly 90% of their net long euro positions in just one month on growing speculation policymakers will pause an aggressive hiking cycle. Economists and markets are both effectively split over the ECB decision, with traders pricing just a 40% chance of one more quarter-point hike on Thursday.

While inflation remains sticky and well above the ECB’s target of 2% — a backdrop that warrants higher rates — signs are mounting that growth is deteriorating. That’s providing fertile ground for bets against the common currency, which has already dropped nearly 5% since mid-July in the longest streak of weekly losses since 2014.

“The euro weakness is warranted — I think the ECB will pause,” said Janet Mui, head of market analysis at RBC Brewin Dolphin in London, adding it will be a “close-call.” “If it stops hiking then the euro may weaken a little further.”

It’s an increasingly common view. While the median prediction sees the euro ending the year at $1.09, up from around $1.07 currently, a few weeks ago the expectation was $1.12. That’s the fastest chop to forecasts in more than a year.

Many are going further and warning of a deeper drop toward parity with the dollar. HSBC Holdings Plc — previously bullish with a euro call for $1.15 — has slashed that to $1.03. Capital Economics reckons it could hit $1 by year-end — a historic level last breached in late 2022. Investors are starting to heed these calls.

“Most hedge funds are bearish euro, and generally bullish the dollar,” said Antony Foster, head of G-10 currency spot trading at Nomura International Plc. “Discussions with clients suggested they are worried about poor survey data not bouncing back, but inflation being sticky. They are worried about energy prices and China.”

It’s easy to see why the optimism has faded. The euro-zone economy barely grew in the second quarter and the pace of corporate bankruptcies more than doubled, while the latest reading of activity showed a contraction is intensifying.

Not long ago, the market was betting that the US would end up in recession while Europe would be able to escape it. Now it’s the other way around. That’s boosted the greenback across the board, with the Bloomberg Dollar Spot Index on its longest weekly streak of gains since its inception in 2005.

The shift in sentiment might not be short-lived. Positioning analysis, which takes into consideration the euro’s moving average and volatility, is flagging a “bearish continuation” signal for the first time in 2023, according to Bank of America Corp.

“This suggests that this downward trend in euro/dollar can continue,” said Athanasios Vamvakidis, head of G-10 currency strategy at the bank. “Euro-zone data has consistently surprised negatively in recent months, particularly compared with data in the US. In Germany, data has been awful.”

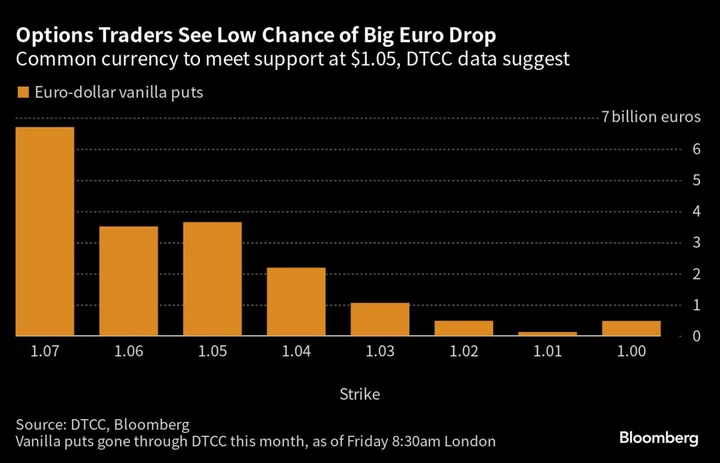

To keep falling, the euro would have to first break through the $1.05 level — a hurdle it’s bounced off several times this year already. Another test of that could draw some investors to take profit on their short positions. That makes it a support level that options traders are mostly betting will hold.

The market should also not underestimate the ECB’s resolve to fight inflation, warned Grace Peters, head of investment strategy for Europe, Middle East and Africa at J.P. Morgan Private Bank. Peters is in the camp that sees another rate hike next week that will support the euro.

“I’m more inclined to buy the euro at these levels,” said Peters. “It’s easy to be a euro bear at the moment because of that growth focus, but the ECB has a single mandate and that is price. This might be the last hike for this cycle, but the ECB will have to stay hawkish. The euro has room for appreciation.”

While the result of next week’s meeting may be too close to call — and even views on the ECB’s Governing Council are diverging — what’s clear is the euro zone is unlikely to be able to handle even higher borrowing costs. That gives the dollar an edge, given the US economy’s greater strength.

“I am not sure the economies of Europe can take much more,” said Luke Hickmore, investment director at Abrdn Plc. “There is a large risk of stagflation here which is not good for almost every type of asset, including the euro.”

--With assistance from Vassilis Karamanis, Naomi Tajitsu and Thomas Hall.