Fitch Ratings upgraded Greece to investment grade, opening the door of a multitrillion-dollar investment pool to the nation’s bonds.

The firm granted Greece a BBB- rating with a stable outlook on Friday, echoing S&P Global Ratings’s decision to upgrade the nation in late October after 13 years with a junk rating.

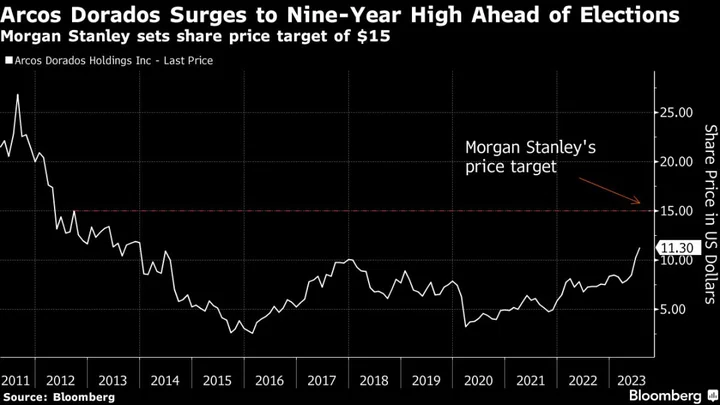

“Fitch expects general government debt/GDP to remain on a sharp downward trend, thanks to solid nominal growth, budget over-execution and a favourable debt-servicing structure,” Fitch said. Policy risks have dissipated following the clear victory of centre-right New Democracy in elections in late June, it also said.

Fitch’s move paves the way for Greek bonds to be readmitted to a number of investment-grade-only bond indexes run by firms including Bloomberg, the FTSE, IHS Markit and JPMorgan Chase. It usually takes a minimum of two BBB- or equivalent rating from the three major companies to be part of such gauges.

The benchmark indexes are followed by numerous passive investment strategies, and active funds dedicated to top-quality bonds often have similar requirements. Greek 10-year bonds are outperform Italian debt since May while the spread versus Spain 10-year yields stands at around 20 basis points.

Greek economy is seen growing by 2.4% this year and the government expects that it will further expand by 2.9% next year, outperforming most of its European peers, while debt ratio is seen declining to 152.3% of gross domestic product in 2024 from the highs of 206% in 2020.

Athens has also pledged to further increase its primary surplus — the balance that shows revenues minus spending excluding interest payments — to 2.1% of gross domestic product in 2024 from 1.1% this year.

After Prime Minister’s Kyriakos Mitsotakis resounding electoral win in June, the nation was already lifted out of junk territory at Japan’s Rating and Investment Information Inc., Germany’s Scope Ratings and Canada’s DBRS Morningstar.

Another sign that the country is gradually returning to normality leaving behind its decade long debt crisis is the state’s divestment from Greek lenders. Since early October the Hellenic Financial Stability Fund — the bailout vehicle that holds the government’s stakes in lenders — sold its entire holdings in two banks and more than a half of its stake in another one.

“Persistent and significant decline in general government debt/GDP, driven for example by fiscal consolidation over the medium term,” could lead to further updates, Fitch said.

--With assistance from Vassilis Karamanis.