Economists are divided over whether South Africa’s central bank will pause interest-rate increases on Thursday, or extend its longest phase of monetary tightening since 2006.

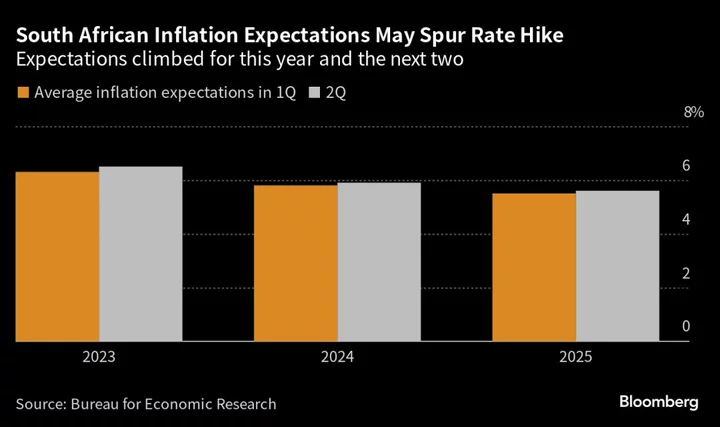

Deteriorating inflation expectations, currency risks and enhancements to the South African Reserve Bank’s quarterly projection model, used to inform its rate decision, are clouding the outlook.

The uncertainty has left economists split in predicting the central bank’s move. HSBC Holdings Plc, Citigroup Inc., RMB Morgan Stanley and Barclays Plc are among the majority expecting a quarter percentage point hike to 8.5%. Goldman Sachs Group Inc., Deutsche Bank AG and Standard Chartered Plc see no change, according to a Bloomberg survey.

“With three months of large declines and downside surprises to inflation, the recent strengthening of the rand, and the weak state of the real economy, we expect the SARB to keep rates on hold,” Goldman’s Andrew Matheny and Bojosi Morule wrote in a client note.

Ream More: Trio of Interest-Rate Hikes to Buck Emerging-Market Easing Trend

Forward-rate agreements used to speculate on borrowing costs show traders are less certain that a quarter-point increase is a done deal after softer-than-anticipated inflation data on Wednesday. Traders dialed back bets on a hike to around a one-in-four chance.

Annual inflation slowed by more than expected to 5.4% in June, dipping beneath the central bank’s target ceiling for the first time in 14 months on lower food costs. The central bank targets price growth at 3% to 6% and prefers to anchor inflation expectations at the midpoint of the range.

The rate decision, expected shortly after 3 p.m. Johannesburg time, could hinge on the vote of a single monetary policy committee member. The median expectation of economists in a Bloomberg survey is that the five-member MPC will vote three in favor of a 25 basis-point hike, and two for a pause.

Raising the key rate to 8.5% from 8.25% would lift it to a new 14 year-high and may mark the final increase in this tightening cycle, according to several economists.

HSBC economist David Faulkner expects a rate hike because of “rising inflation expectations, higher global policy rates, large external and domestic financing needs, and a potential rise in the neutral real rate as the SARB starts to incorporate fiscal risks and policy into its measure of risk premium,” he said.

The MPC has hoisted interest rates by 475 basis points since November 2021 to contain inflation that’s been above the 4.5% midpoint of the target range for more than two years. Its May forecasts showed headline inflation reaching the midpoint only in 2025.

Governor Lesetja Kganyago and his deputy Kuben Naidoo said earlier this month that only once the MPC is confident that inflation is returning to the midpoint will it stop tightening policy.

(Updates with comment from HSBC in paragraph nine)