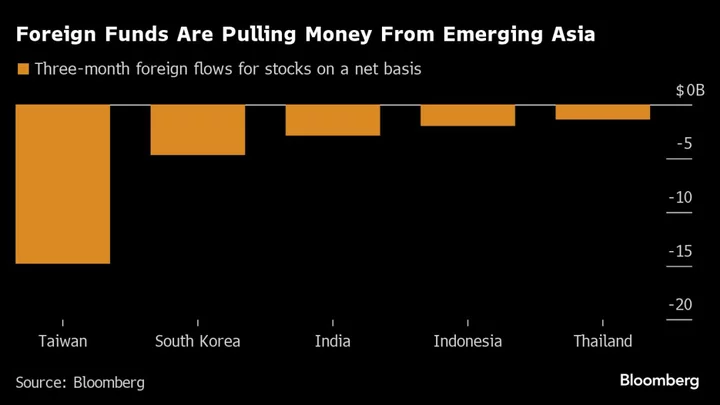

Global funds are offloading emerging Asia equities outside of China in droves as broader risk appetite cools amid concerns over a stronger dollar, higher borrowing costs and geopolitical tensions.

Foreign investors have dumped nearly $11 billion of shares in October, taking the three-month selloff to about $27 billion, according to latest data compiled by Bloomberg. That’s the longest bout of selling since last June when the Federal Reserve’s tightening cycle and lockdowns in major Chinese cities were spooking investors.

Continued uncertainty about the path of US interest rates and potential impact of the Israel-Hamas war on oil prices — which almost reached $100 a barrel last quarter — have weighed on a region where most countries are oil importers. A stronger dollar is also straining local currencies as Treasury yields flickered near 5%, making equities less attractive.

“We are still keeping a cautious view, because we think that earnings estimates for 2024 are too high” in Asia, said Luca Castoldi, a hedge fund manager at Reyl Group. US growth will not be strong in 2024 and the effect of higher rates is being felt across sectors, he added.

Foreigners have pulled more than $4 billion worth of shares from Taiwan this month, while redeeming more than $2 billion from Korean and Indian markets. Meanwhile, China’s stock market also continues to see outflows amid persistent concerns about the health of the property sector as well as the weak broader economic recovery.

READ: Emerging Market ETFs Lose Cash While Traders Boost Ex-China Bet