Global bonds took another leg lower after the Bank of Japan signaled it will allow yields to climb above its previous cap, partly unwinding the world’s most dovish policy settings.

Japanese 10-year yields jumped as much as 13.5 basis points to 0.575% after the decision, above the BOJ’s earlier cap of 0.5%. Similar-maturity US Treasury yields climbed to within a whisker of an eight-month high, while those in Australia extended their earlier increase to as much 20 basis points.

The BOJ maintained its target for 10-year yields at around 0% but said the 0.5% ceiling was a reference point, not a definite limit as it aimed to make its easing program more flexible.

Japan’s 10-year yield has hit the highest since 2014, “and all other things being equal, this should continue to creep up in the days and weeks to come and removes an anchor for global yields,” said Jim Reid, a strategist at Deutsche Bank AG in London.

Bond markets around the world have been under selling pressure in recent months as the US economy has remained resilient despite a string of Federal Reserve interest-rate hikes and as inflation in Europe has remained elevated. An index of global government debt has dropped for six of the past seven days and is now about 2.5% down from this year’s high set in February.

The BOJ’s move “will be interpreted by Treasury investors as a selling pressure because Japan’s government bond yields will likely move higher,” said Gordon Tsui, managing director and head of fixed income of Ping An of China Asset Management (Hong Kong). “Yen-based investors will become cautious on unhedged foreign currency exposure and need to manage down such mismatch. This will exert strengthening pressure on the yen.”

Warning Signs

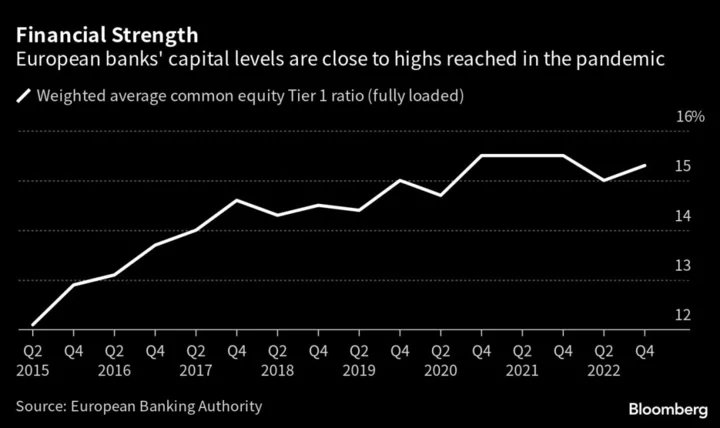

Investors have long been warned that any BOJ move toward policy normalization may lure a wave of Japanese cash flowing back home and away from global financial markets. Japanese funds are the biggest foreign holders of US government debt and own everything from Brazilian sovereign debt to European power stations and bundles of high-risk loans.

That would be bad news for bond bulls who are betting the Fed is near the end of its policy tightening and will soon have to cut interest rates to avoid a US recession. Jupiter Asset Management says the 10-year Treasury yields may fall 150 basis points by the end of next year, while DoubleLine Capital LP’s Jeffrey Sherman argues that the Fed may slash rates by one percentage point.

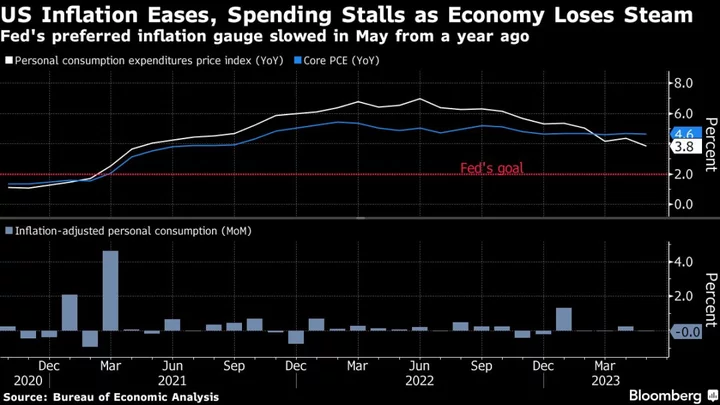

The Fed this week raised the target range for its benchmark federal funds rate by 25 basis points to the highest level since 2001. That was an 11th increase since March 2022.

The BOJ’s decision Friday is a further sign Japanese policy makers are finally stepping back from their super-accommodative policy, having long lagged hawkish peers such as the Fed and European Central Bank. The yen has been under pressure for most of this year due to the widening interest-rate gap between the BOJ and its global counterparts.

“The yield-curve-control tweak opens room for the 10-year JGB yield to go higher, which may discourage some Japanese investors from investing in government bonds in some of the other developing markets,” said Frances Cheung, a strategist at Oversea-Chinese Banking Corp. in Singapore. Still, that will depend on how quickly Japanese yields climb and how appealing the potential returns are to investors, she said.