A look at the day ahead in European and global markets from Brigid Riley

Germany is first up to bat today with its consumer price index, hitting off a week of big inflation data drops around the globe, while market participants are also keeping an ear out for more U.S. Federal Reserve speakers taking the podium on Tuesday.

Europe's largest economy looks set to match its June 0.3% increase in consumer spending, something that's likely to buttress expectations of a pause at the European Central Bank's next interest rate meeting in September.

The data is a prelude to a duo of highly anticipated inflation figures from China on Wednesday and the United States on Thursday, which are widely expected to paint very different pictures of their respective economies.

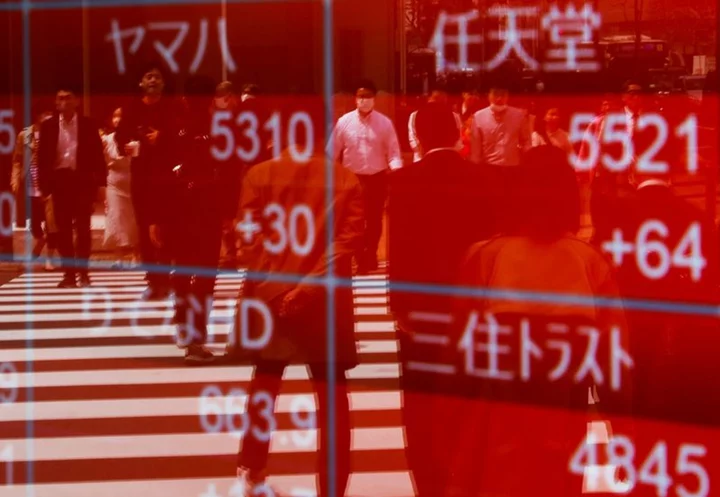

China has been hit by a storm of negative indicators, including trade numbers out on Tuesday that showed misses for both imports and exports.

Markets don't seem to know what to make of the data. A knee-jerk bounce in mainland blue chip stocks <.CSI300), probably on the idea that stronger government stimulus measures must be on their way, very quickly fizzled out.

Still, investors' focal point for the week is the U.S. consumer price index amid recent goldilocks data and remarks from Fed Chair Jerome Powell that's given strength to the economic soft-landing narrative.

Fed officials continue to emerge from their silence this week after hiking rates another 25 basis points at their last meeting. Investors betting the Fed has reached the end of rate increases will have another chance to gauge their theory when Philadelphia Fed President Harker and Richmond Fed President Barkin speak on Tuesday.

Their remarks will be top of investor watchlists after mixed messages about the future rate path from New York Fed President John Williams and Fed Governor Michelle Bowman on Monday. Bowman's comments suggesting more rate hikes in particular gave markets a jolt.

In Asia, Japanese wage growth cooled from the highs of May, Tuesday's release showed, with real wages extending a contraction for the 15th month as inflation ate away at gains.

Wages are a favourite data point of the Bank of Japan in deciding its future rate path, something highlighted yet again in BOJ minutes out on Monday.

Japanese wage-watchers can perhaps take solace in seeing signs of broadening wage hikes.

Key developments that could influence markets on Tuesday:

- German CPI and HICP data (July)

- Hungary CPI (July)

- U.S. trade balance (June) and NFIB Business Optimism Survey (July)

- Fed's Harker and Barkin speak

- Bayer, InterContinental Hotels earnings report

(Reporting by Brigid Riley; Editing by Christopher Cushing)