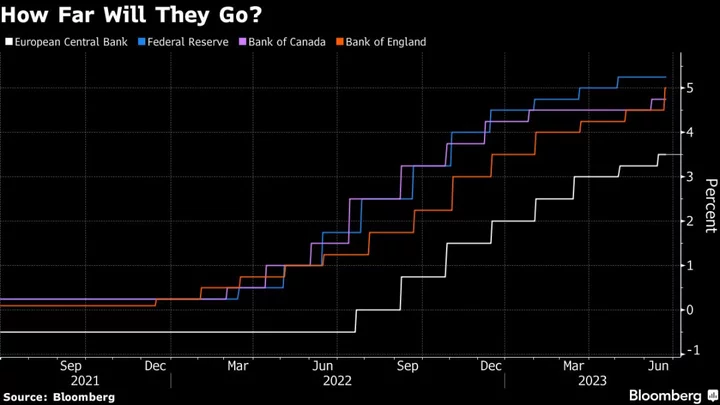

The unprecedented cycle of global interest-rate increases is entering its most challenging stretch as inflation threatens to become entrenched, according to the Bank for International Settlements.

“Despite the most intensive monetary policy tightening in recent memory, the last leg of the journey to restore price stability will be the hardest,” the Basel-based institution said in its annual economic report published Sunday. “Interest rates may need to stay higher for longer than the public and investors expect.”

While policymakers have raised borrowing costs aggressively to tame consumer prices, the easing in inflation pressures seen so far has primarily been due to supply chains recovering and commodity costs falling.

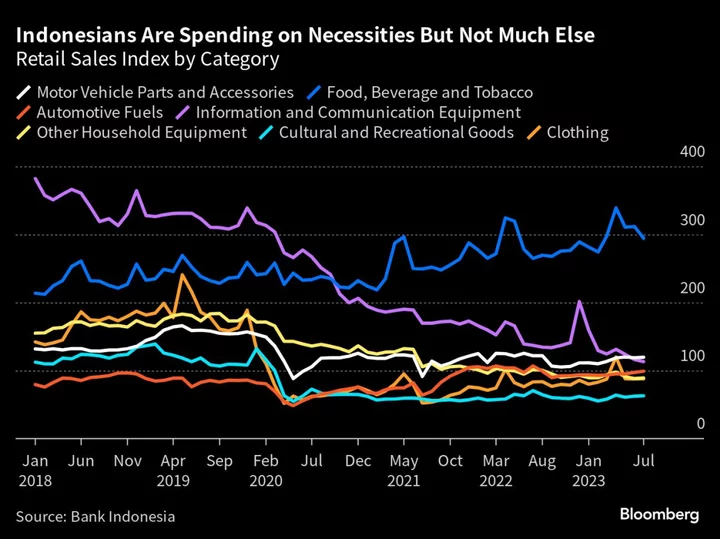

Tight labor markets and persistent more expensive services create a “material risk that an inflation psychology will take hold, where wage and price increases start to reinforce each other,” the BIS said.

Those words of caution chime with recent warnings from central bankers that undefeated inflation is locking them into a new phase of monetary tightening.

After a Federal Reserve pause earlier in June, Chair Jerome Powell struck a hawkish tone last week, suggesting one or two more rate increases may be needed. Similarly, the Bank of England and Norges Bank unexpectedly re-accelerated their pace of tightening to 50 basis points on Thursday.

The volatility of the inflation environment is the theme of the European Central Bank’s annual forum in Sintra this week, which the chiefs of those institutions will all attend. Powell will share a panel with ECB President Christine Lagarde, BOE Governor Andrew Bailey and Kazuo Ueda of the Bank of Japan on Wednesday.

- Follow Wednesday’s TOPLIV Blog on the panel from Sintra here

“The global economy is at a critical juncture,” BIS General Manager Agustin Carstens told journalists in a briefing. “There is a chance that we can secure a softish landing, but we have to tackle the risks.”

Traders have scrapped once-aggressive wagers that the Fed chief will pivot to easing policy before the end of this year, reflecting deeply diminished expectations that the central bank’s rate hikes are poised to set off a sharp recession.

That’s in line with US Treasury Secretary Janet Yellen, who said in an interview last week that the odds of an event have fallen.

A Bloomberg survey of economists published Friday also showed the consensus now is that the US will dodge such an outcome this year. Forecasters still reckon underlying inflation will be faster than previously thought.

Aside from the way back to price stability taking longer than expected, the BIS report points to the risk that sustained tightening cycles might trigger significant stress for the financial system — which already has seen a tough year in the US and Switzerland — especially through the channel of real estate debt.

Historically, many high-inflation episodes were followed by a banking crisis within three years, the BIS said.

Research presented in the report also showed that:

- In recent decades, monetary and fiscal policy gradually moved toward the boundaries of a so-called “region of stability,” as “they were often relied upon as de facto engines of growth.”

- Policy changes aimed at structural changes, along with institutional safeguards, are needed to lay the foundation for sustainable growth.

- A new digital financial markets infrastructure — a so-called unified ledger – could bring digital central-bank money and private tokenized assets together and thereby yield significant economic benefits.

The BIS, which comprises more than 60 central banks as members, defines itself as a bank for central banks and is the world’s oldest international financial organization. It aims at promoting monetary and financial stability and acts as a forum for cooperation among central banks and the financial community.