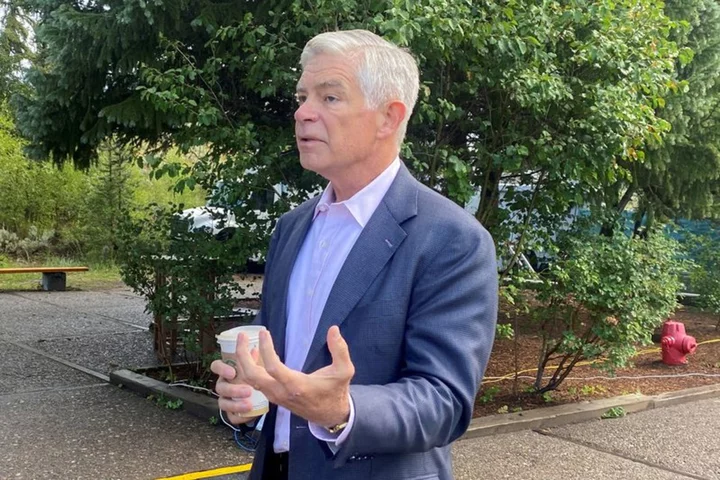

Federal Reserve Bank of Philadelphia President Patrick Harker said on Wednesday that for the moment he is inclined to support a "skip" in interest rate hikes at the central bank's next meeting in June, although economic data due soon could change his mind.

"I am in the camp increasingly coming into this meeting thinking that we really should skip," Harker said at an event on financial stability. That said, data due on Friday about the U.S. job market "may change my mind."

Harker was the latest Fed official to lend his support to the notion that the central bank could "skip" a rate hike for a single meeting as opposed to "pause" increases for perhaps a longer stretch.

The Fed has raised rates for 10 meetings in a row, lifting the benchmark federal funds policy rate by 5 percentage points in that run to the current level of between 5.0% and 5.25%.

At their meeting earlier his month, policymakers opened the door to taking a break at the coming June 13-14 meeting. Several of them since have emphasized that even if they forego a hike then, it does not preclude more increases later on.

Harker echoed that sentiment, adding that he does not like the word "pause."

"A pause says that you are going to hold there for a while," he said. While at some point, Harker said, officials may hold rates steady for a longer period, he didn't know whether that moment was now at hand.

Fed policymakers need to be prepared to do more increases if inflation is not sufficiently responsive to the hikes already delivered, he said, and he is "willing to do that, but I want to give it a little bit of time."

(Reporting By Dan Burns; Editing by Chizu Nomiyama)