Two Federal Reserve officials said at least one more interest-rate hike is possible and that borrowing costs may need to stay higher for longer for the US central bank to ease inflation back to its 2% target.

While Boston Fed President Susan Collins said further tightening “is certainly not off the table,” Governor Michelle Bowman signaled that more than one increase will probably be required, cementing her position as one of the Federal Open Market Committee’s most hawkish members.

“I continue to expect that further rate hikes will likely be needed to return inflation to 2% in a timely way,” Bowman said in remarks to the Independent Community Bankers of Colorado in Vail Friday.

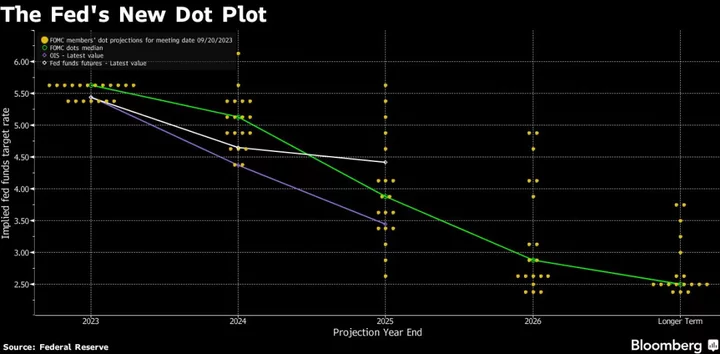

While the FOMC on Wednesday held its target range for the federal funds rate at 5.25% to 5.5% — a 22-year high — fresh quarterly projections showed 12 of 19 officials favored another rate hike in 2023, underscoring a desire to ensure inflation continues to decelerate.

One policymaker sees rates peaking above 6% next year, while central bankers overall see fewer cuts than previously anticipated in 2024, in part due to a stronger labor market. Bowman’s comments suggest she might have the highest interest-rate forecast for next year.

Collins, who does not vote in monetary policy decisions this year, said she “fully” supported the guidance offered in Fed officials’ quarterly economic projections. Speaking at an event hosted by the Maine Bankers Association on Friday, Collins said that the current phase of policy will require “considerable patience.”

Read More: Fed’s Collins Says Rates May Need to Stay Higher for Longer

While there has been good progress in lowering inflation, higher energy costs present a risk for achieving the 2% inflation goal, Bowman said.

“I see a continued risk that energy prices could rise further and reverse some of the progress we have seen on inflation in recent months,” she said.

The personal consumption expenditures price index, the Fed’s preferred inflation gauge, rose 0.2% in July, posting the smallest back-to-back increases since late 2020. The core PCE price index, which strips out the volatile food and energy components, also rose 0.2% in July for a second month, underscoring the progress the Fed has made in taming prices.

Policymakers are set to receive fresh inflation data for August on Sept. 29.

Bowman also noted that monetary policy appears to be having less bite on lending than might be expected.

“Despite this tightening of bank lending standards, we have not seen signs of a sharp contraction in credit that would significantly slow economic activity,” she said.

Separately on Friday, San Francisco Fed President Mary Daly said she is not ready to declare victory in the fight against inflation, and that the central bank is still committed to curbing price pressures “as gently as possible.”

“We will not be satisfied that we are where we need to be” until there is more confidence that inflation is on a path back to price stability, Daly said during a fireside chat coordinated by Greater Phoenix Leadership.

Daly, who does not vote on monetary policy decisions this year, also said policymakers decided to hold rates steady “so that we have more time to collect the information we need.” She did not comment directly on whether she expects the Fed will raise rates once more this year, as most officials expect.

(Updates with inflation data in ninth paragraph.)

Author: Craig Torres, Jonnelle Marte and Laura Curtis