European stocks extended gains into a second session, as China’s decision to relax travel curbs offered a lift to travel and luxury goods companies.

The Stoxx 600 Index rose 0.6% by 8:33 a.m. in London, with shares in LVMH, Hermes and Richemont gaining as much as 2.3% after China’s announcement that it would lift a ban on group travel to several countries, including the US and UK.

The relaxation, which could offer a significant boost to the global tourism market, sent Europe’s travel and leisure subindex 1% higher. Insurance shares as well as consumer products and services outperformed the regional benchmark, while declines were led by basic resources stocks and health-care.

In earnings-related news, Allianz SE shares rose after posting a second-quarter profit jump, benefiting from strong performance in its insurance business. Europe’s second-biggest firm Novo Nordisk A/S fell, however, after the drugmaker warned that supply of the obsesity medicine Wegovy would continue to be restricted in the US due to capacity constraints.

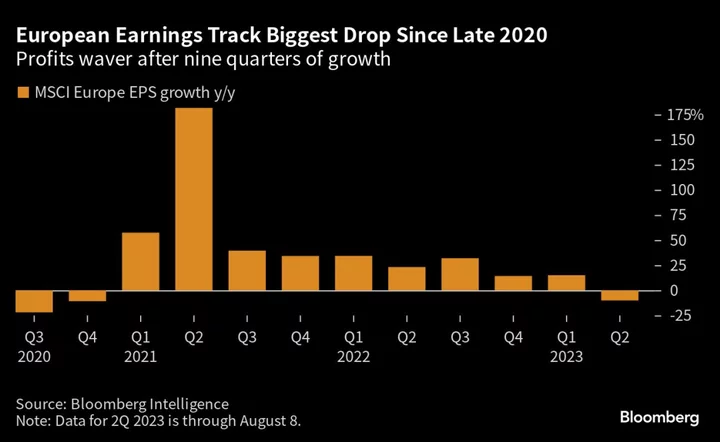

Meanwhile, data from Bernstein showed that Europe is headed for the worst quarter of earnings since late 2020, with the drag mainly coming from the energy sector.

The other major focus for markets is the US data later on Thursday. Economists expect the print to show a further slowdown in the key core inflation gauge, potentially enabling the Federal Reserve to end its policy-tightening cycle. However, many reckon a softer print is already priced in and any upside surprise could jolt markers.

“With the market already embracing the ‘soft landing’ narrative, a slightly lower-than-expected print would only reinforce this belief without necessarily triggering a very positive reaction,” said Julien Lafargue, chief market strategist at Barclays Private Bank.

“On the other hand, a hot CPI would revive expectations for more Fed interest rate hikes, putting pressure on yields and therefore on equity valuations.”

For more on equity markets:

- US CPI Data Loom Big After Bumpy Start to August: Taking Stock

- M&A Watch Asia: Fortress, Wyloo, Fortescue Metals, L’Occitane

- L’Occitane Listing Would Boost Europe as Consumer Hub: ECM Watch

- Coke Bottler Boosts Outlook as Inflation Eases: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Farah Elbahrawy.