European natural gas dropped on Friday in its longest run of weekly declines in more than three years, as demand remains muted even with the fuel becoming increasingly more economic than coal for power generation.

Benchmark futures tumbled on Friday, ending a six consecutive week with a loss and extending this year’s slump to more than 55%. While cheaper gas has opened the door for increased switching from coal in power generation, consumption remains weak as the region recuperates from last year’s energy-price shocks.

“Due to the slow recovery of industry, overall electricity demand still remains very low,” said Florian Rothenberg, an analyst at commodities consultancy ICIS. Plus, May is always a strong month for renewable generation, which for the time being is covering about 51% of Europe’s power mix, he said.

Traders will be closely watching how the situation evolves in the coming months. High fuel stockpiles and ample supplies of liquefied natural gas have helped to keep a lid on prices. But weather and climate issues remain a persistent factor. Last summer, Europe faced abnormal heat and drought that affected hydro power and some nuclear plants, bolstering the use of gas.

For now, the market “is calm due to strong supply, and it will likely take a heat wave either in Europe or Asia to change the picture,” analysts at trading firm Energi Danmark A/S said in a note.

May Data

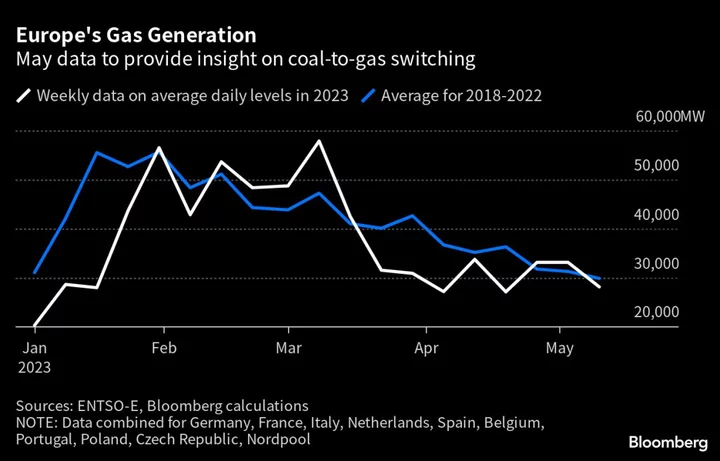

Combined gas-fired power generation in key European Union members has moved closer to seasonal norms in recent days — after being far below that level in April — while coal burn dropped, according to data from grid group ENTSO-E, compiled by Bloomberg.

“May will be the first full month where gas is much cheaper than coal, maybe we see stronger signs of switching,” said Fabian Ronningen, a power analyst at Rystad Energy AS.

Dutch front-month gas, Europe’s benchmark, traded 6.3% lower at €32.80 per megawatt-hour by 5:08 p.m. in Amsterdam, the lowest level since July 2021. The UK equivalent contract dropped 5.6%. German power prices for next month also slipped.

To be sure, the spark and dark spreads — which measure the profitability of running gas- and coal-fired plants — still favor coal for the upcoming heating season and into next year, albeit at much lower margins than in 2022.

In the longer term, all thermal power plants will be under “significant downward pressure” across Europe given increasing output from renewables, said Emma Champion, head of regional energy transitions at BloombergNEF. “This trend outstrips the upside gas plants can capture even with improved fuel switching economics vs coal.”

--With assistance from Elena Mazneva.