European banks are building out their risk models to better prepare for the fallout from climate change, with some even examining the short-term liquidity implications of a hotter planet, according to a joint survey conducted by the Association for Financial Markets in Europe and Oliver Wyman.

The analysis, published on Thursday, found that 87% of the banks surveyed have started conducting their own annual internal climate stress tests, in some cases using modeling that goes beyond requirements set by regulators. That’s amid a general consensus that previous exercises understated the real risks, the survey found.

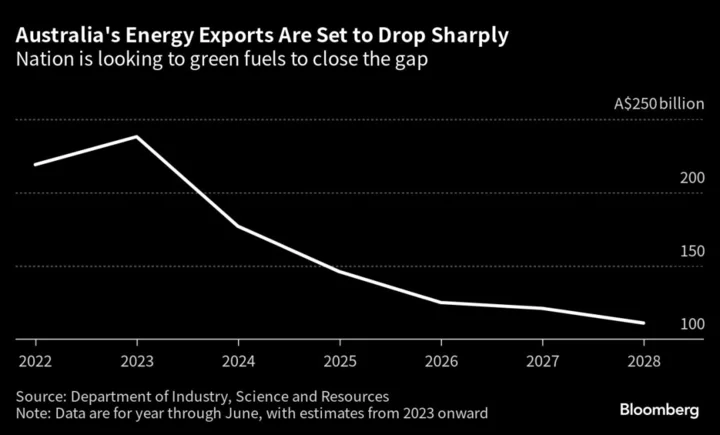

The results indicate that banks are increasingly concerned about the potential of global warming to hurt asset values. Credit risk is by far the biggest concern, especially for banks heavily exposed to the fossil-fuel sector and for lenders with big mortgage books. The analysis also revealed that some banks are trying to map out how they’d fare in scenarios in which the fossil-fuel sector rapidly loses value, as they build out their models.

“While focused initially on credit risk and market risk, banks responding to the survey shared that they have expanded the scenario analysis to operational risk and are exploring the possibility of covering additional risk types,” AFME Chief Executive Officer Adam Farkas said in the report, which was based on an analysis of 15 banks representing close €15 trillion ($16.4 trillion) in combined assets.

New areas of concern include business liquidity as well as interest-rate risk in the banking book, he said. In fact, about one-third of the banks surveyed said they were already modeling for such risks, the survey showed.

At the same time, only around one-third of banks surveyed said they currently consider it “relevant” to discuss strategies with clients to mitigate climate risks.

The report by AFME and Oliver Wyman found that a climate stress test conducted by the European Central Bank in 2022 probably underestimated the real risks associated with a hotter planet. The landmark exercise was softer than many in the industry had expected, and didn’t expose losses that would leave a meaningful dent in capital buffers.

The ECB test was a “valuable learning exercise,” the report said. However, the industry now requires better guidelines to help banks prepare for the wider array of climate risks being identified, it said.

“While the ECB good practice guide is a useful starting point, further supervisory guidance on how banks should build their internal stress testing and modeling capabilities would help to drive greater industry consistency,” the report said.