Eli Lilly & Co. won US approval for its diabetes drug to treat obesity, unlocking blockbuster sales potential and sparking a battle for dominance of a market that’s expected to hit $100 billion by 2030.

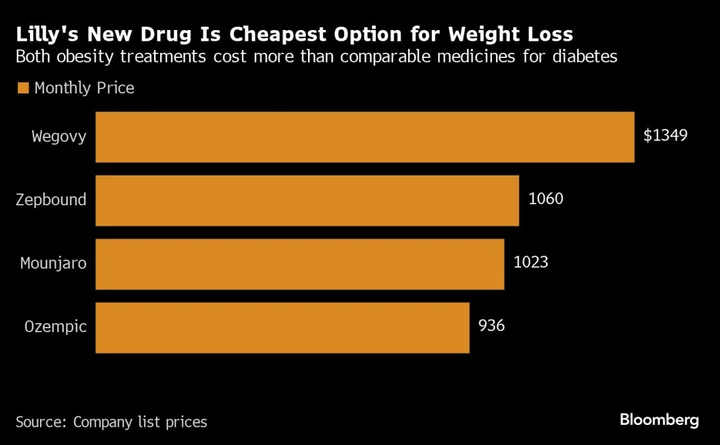

The weight-loss drug, branded Zepbound, contains exactly the same active ingredient as the company’s diabetes drug Mounjaro, and will cost $1,059.87 for a month’s supply. It will be available by year end. That’s cheaper than Wegovy, a similar weight-loss drug made by Novo Nordisk A/S, which is $1,349 for a month’s supply.

In trials, patients who received the highest dose of Lilly’s Zepbound lost on average 18% of their body weight, the US Food and Drug Administration said in a statement.

Lilly’s shares rose 2.5% at 2:52 p.m. in New York. They have gained 64% so far this year as of Tuesday’s close.

The mania over weight-loss drugs is drawing responses from all kinds of industries like airlines, dialysis centers and big box chains like Walmart, sending stock markets into a frenzy. Mounjaro, which Lilly couldn’t market for obesity prior to Wednesday’s approval, was publicized by Hollywood where it also became a punchline. The last time there was this much hype over a new drug was for Viagra, which was approved in 1998.

The promise of these drugs has boosted Lilly and Novo to record heights. Lilly is now the most valuable health-care company in the world, while Novo, the maker of Ozempic and Wegovy, became Europe’s most valuable company in September. The intense popularity of the drugs has also led to ongoing supply shortages, though. Both companies have been investing heavily to make more of their drugs, and Novo is limiting the sale of Wegovy to new patients in order for people who are already on the drug to stay on it.

Despite the “billions of dollars invested in ramping up supply, we do recognize that the demand for these products is significant,” Anat Ashkenazi, Lilly’s chief financial officer, said in an interview last week. “We’ll likely be in a tight situation for quite sometime.”

Patient Roadblocks

Insurance companies have so far been reluctant to cover Wegovy for obesity because of its price. Medicare, the government health program for seniors, doesn’t currently cover weight-loss drugs.

The drugs, known as GLP-1 receptor agonists, also come with some side effects. Zepbound’s include nausea, diarrhea, vomiting, constipation and abdominal pain, the FDA said in a statement. The new label also includes a warning for suicidal behavior and thinking, which is not included on the Mounjaro label. US regulators have said they’re monitoring international probes into patient reports of suicidal thoughts that may be associated with weight-loss drugs.

In the US, labels for Novo’s Wegovy and Saxenda already include warnings for suicidal behavior and thoughts and recommend that patients are monitored for worsening symptoms.

Mounjaro was approved last year as a treatment for adults with type 2 diabetes. The dramatic weight-loss effects seen in studies have driven off-label use, which is when doctors prescribe drugs for conditions for which they haven’t gotten regulatory clearance. Sales of Mounjaro in the third quarter rose to $1.41 billion, up 44% from the three months ending in June and ahead of analysts’ average estimate of $1.26 billion.

Lilly is studying the drug in younger patients, which could further boost sales. Lilly recently started a trial in kids ages 12 and up with obesity, and is planning to do a similar one in patients as young as six years old.

The company’s obesity pipeline doesn’t stop there. It’s also testing a pill version of its obesity drug in late-stage studies. Several other experimental obesity treatments are earlier in development, including one that Lilly recently acquired from startup Versanis Bio for up to $2 billion. US sales across Lilly’s late-stage obesity portfolio could reach $52 billion in 2030, Goldman Sachs analysts said in a note.

--With assistance from Robert Langreth, John Tozzi and Catherine Larkin.

(Updates shares and with detail throughout.)