The Federal Reserve’s preferred underlying inflation measure will be slower to recede, which should keep interest rates higher for longer, according to Bloomberg’s latest survey of economists.

Forecasters marked up their projections for the annual so-called core personal consumption expenditures index largely through the end of next year, per the results of the November survey. The measure, which excludes the volatile food and energy categories, is seen at 2.5% at the end of 2024, up from 2.4% in last month’s poll.

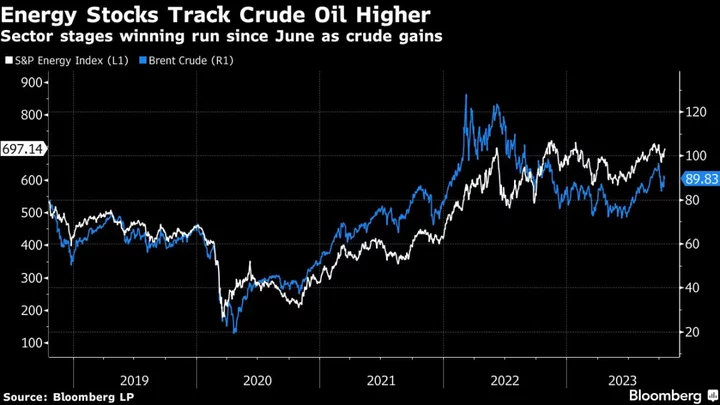

Meantime, the overall PCE metric and the alternative consumer price index are seen receding faster than previously thought through mid-2024. Those measures have shown greater disinflation in recent months largely due to a pullback in energy prices.

While recent reports have showed encouraging signs that price pressures are easing, Fed officials have repeatedly indicated they must see sustained signs of cooling before declaring victory on inflation. Policymakers favor the core gauge as a better indicator of underlying price pressures.

Though economists still expect the Fed to start loosening monetary policy in the second quarter of next year, they now see the central bank keeping interest rates higher through the end of 2025.

“The recent slowing in inflation, employment growth and consumer spending supports our call that the Fed is done raising rates for this cycle,” said Kathy Bostjancic, chief economist at Nationwide Life Insurance Co. “However, given inflation remains still high and will decline just gradually, the Fed will wait to cut rates until mid-2024 and the easing of policy will be gradual.”

Weaker Growth

Forecasters expect the economy to expand at an annualized 1.2% pace in the current quarter, up from 0.7% in the previous survey. Though stronger consumer and government spending are seen aiding the economy in the short run, economists are now projecting a major slowdown in private investment to dampen growth through early 2025.

Consumer spending has proven largely resilient as the job market remains broadly strong, but demand for workers is slowly starting to soften. Economists still project the unemployment rate to peak at 4.4% but now see it taking longer to come down. They also expect the US to add fewer payrolls on average through 2025.

“With real household disposable incomes turning negative, pandemic era savings showing signs of being exhausted amongst lower income groups and borrowing levels turning lower we expect the Fed to respond with interest rates cuts from 2Q onwards,” said James Knightley, chief international economist at ING.

The survey was conducted between Nov. 17-22 and included responses from 73 economists.