European Central Bank Governing Council member Francois Villeroy de Galhau said investor bets on interest-rate hikes are “excessively volatile” and urged against drawing premature conclusions on where borrowing costs may eventually peak.

The French central bank governor’s comments sound a more dovish tone than many of his colleagues — several of whom warned Friday that the historic monetary-tightening campaign may need to extend into the fall. Villeroy has previously said it would be end by the September meeting at the latest.

“Nobody should rush to a premature conclusion about our calendar nor about our terminal rate,” Villeroy said at a speech in Paris. “The latest market volatility on this terminal rate seems somewhat excessive.”

Read more: ECB Hawks Warn Rate Hikes May Need to Persist Beyond Summer

While the majority of analysts still expects the ECB to pause in September after another hike in July, markets are almost fully pricing a further increase beyond that — boosted by a slight upward revision this week in quarterly inflation projections.

Villeroy played down the importance of forecasts and said the latest set are “rather cautious” as the ECB is confident it will deliver on its 2% inflation target in the next two years.

“We are data-driven, we are not forecast-driven,” he said. “Recent data show that even if we are obviously still far from the inflation target, our monetary policy is at work, and is working: Inflation has peaked in the euro area, core inflation has declined for the second consecutive month, and there are several other signs that underlying price pressures are softening.”

Other comments Villeroy:

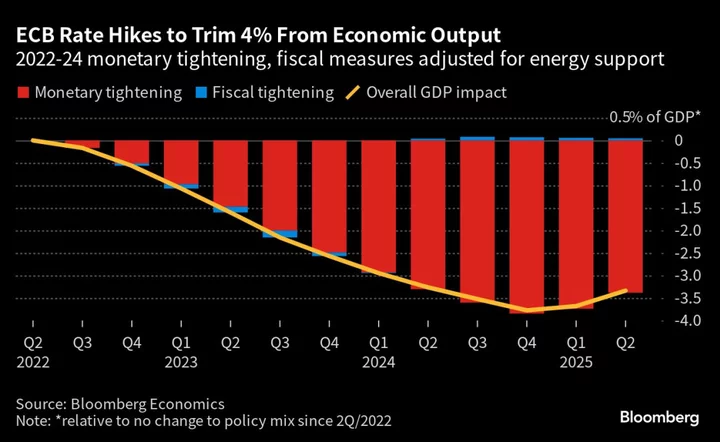

- “We have already shown our determination on interest rates through this overall 400 basis point increase”

- “We obviously covered most of the ground, and we are clearly in restrictive territory on all maturities: the key issue now is the transmission of our past monetary decisions, which is proceeding forcefully to financial conditions but could take up to two years for its full economic effects”

- “The duration matters more than the level; persistence matters more than the peak.”