European Central Bank Governing Council member Mario Centeno said there are concerns over whether the euro-area economy will have a soft landing following a lack of growth in recent quarters.

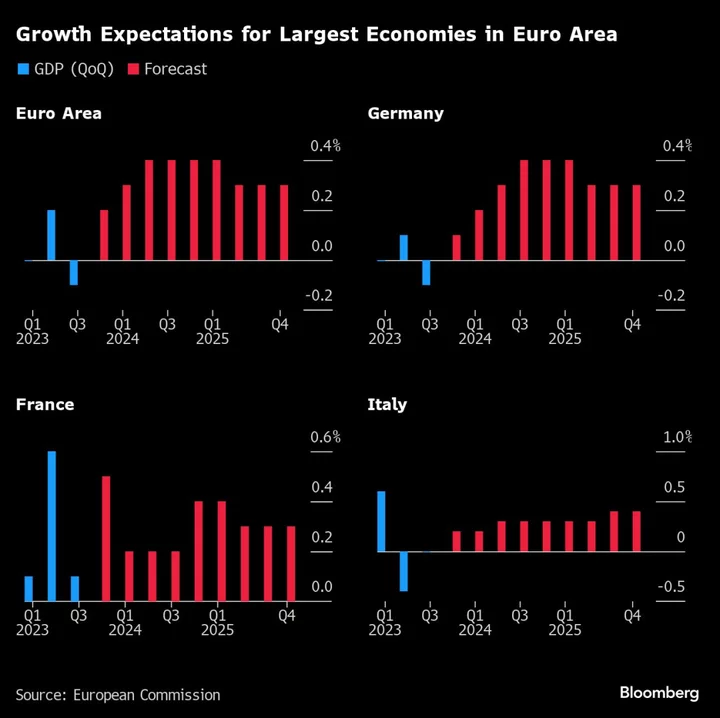

The ECB’s rate aggression has weighed on the bloc, which contracted in the third quarter and is expected to stagnate in the final three months of the year. Former ECB President Mario Draghi said last week that the euro area is “almost sure” to experience a recession by the end of 2023.

“The numbers have not been great, zero, 0.1, -0.1 quarter-on quarter for five quarters in a row creates a little bit of anxiety over will this be a soft landing,” Centeno told Bloomberg Television on Wednesday. “I’m not worried about a recession, but I am concerned that downside risks may materialize.”

“This stagnation of the euro area is of course a source of concern for all,” he said. “It will help bringing inflation down, that’s for sure.”

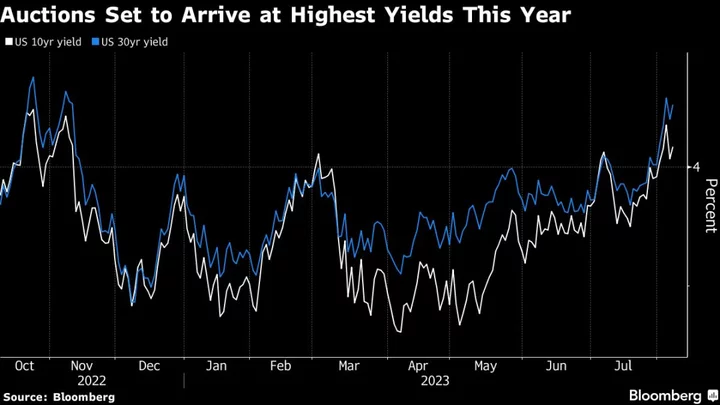

After a record tightening cycle, the ECB is now likely at peak rates and officials including President Christine Lagarde have indicated that the deposit rate will stay at 4% well into 2024. Markets are less sure, betting on cuts as soon as April.

Not all of the ECB’s rate aggression has fed through so far, according to Centeno.

“In a round number, we are halfway on transmission of monetary tightening, there’s still more to come,” he said in a separate interview.

Centeno spoke just before the European Commission published fresh forecasts. Those predictions showed that the euro area and its biggest economies will avoid a recession as growth returns at the end of the year, helped by slowing inflation and a robust jobs market.

Euro-area inflation is at its weakest in more than two years, though at 2.9% it’s still above the ECB’s 2% goal. Policymakers have warned of a difficult “last mile” back to price stability as government aid to cope with the cost-of-living crisis is withdrawn and workers’ salaries rise.

Base effects are also about to kick in, with ECB Vice President Luis de Guindos warning earlier this week that inflation will see a temporary uptick in the coming months.

Centeno, who is among the more dovish ECB rate setters, said convergence toward the central bank’s target will be slower from now on.

“We have seen good progress hitherto, we’ll see more resistance in inflation as it heads toward 2%,” the Portuguese central banker said. “It will be between 2% and 3% for some time, but probably nearer to 3%.”

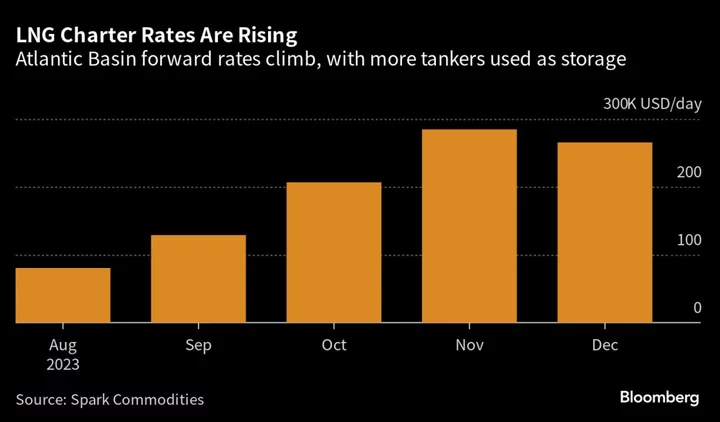

While the inflation reading for November is expected to be “very good,” things getter tougher after that, he said. “We know the sources of this: there is a little uptick of inflation coming from energy.”

Centeno added that the ECB doesn’t see any sign of second-round effects.

“Real wages since the beginning of the inflationary process fell by 6% cumulative in the euro area,” he said. “This is expected to recover a bit but that doesn’t mean that second-round effects will be materializing. The labor market in Europe is very strong and is showing signs of flexibility and adaptation that were not known in the past.”

Centeno added that the ECB needs to reduce its balance sheet and said he sees no reason today to accelerate its asset purchase program.

--With assistance from William Horobin, Aline Oyamada, Philip Aldrick, Flavia Krause-Jackson and Stephanie Flanders.

(Updates with additional Centeno comments starting in the third paragraph.)

Author: Anna Edwards, Tom Mackenzie and Joao Lima