A stronger-than-expected corporate earnings season alone won’t be enough to boost the S&P 500 this time around, according to one of the most bearish voices on Wall Street.

Morgan Stanley’s Michael Wilson — whose pessimistic view on US stocks has yet to materialize this year — says company forecasts will matter more than usual given elevated equity valuations, higher interest rates and dwindling liquidity.

“With second-quarter earnings beginning this week, ‘better than feared’ likely isn’t going to cut it anymore,” Wilson wrote in a note. The strategist said he expects further cuts to analysts’ earnings projections in the second half of the year, “so the key for stocks will come via company guidance for the out quarter rather than the results themselves.”

Wilson joins a growing chorus of both market strategists and investors who foresee a choppy outlook for stocks after their first-half rally. There’s early evidence of that playing out in July, with the S&P 500 posting a decline last week amid fears of a hawkish-for-longer Federal Reserve.

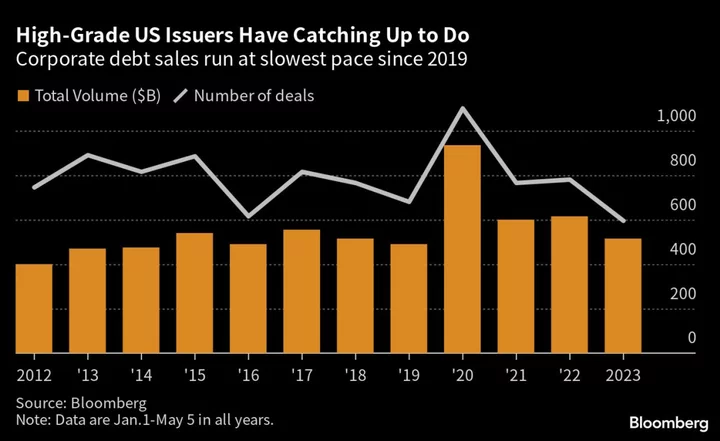

Bloomberg’s latest Markets Live Pulse survey also found that participants are bracing for profit warnings and higher interest rates to spark further declines in the S&P 500 this earnings season, which kicks off with reports from the big US banks on Friday. Overall, analysts expect second-quarter earnings to have fallen almost 9% — the biggest year-over-year decline since 2020, according to data compiled by Bloomberg Intelligence.

Meanwhile, the team at Goldman Sachs Group Inc. said they expect US companies to “meet or exceed the low bar” set for the second quarter. However, they view analysts’ expectations of a rebound in profits in 2024 as “too optimistic.”