Dollar General Corp. is quickly losing fans on Wall Street after cutting its profit forecast for a second straight quarter as the discount retailer faces increased competition while economic pressure builds on consumers.

At least six analysts tracked by Bloomberg downgraded their recommendations following Dollar General’s earnings report Thursday, which signaled the retailer is underperforming rivals including Dollar Tree Inc. and Walmart Inc. Meanwhile, Dollar General projected that higher labor costs and efforts to curb inventory growth will pressure profit this year. The company dropped 5.9% on Friday after closing a day earlier at the lowest level since March 2020.

“DG has become a ‘show me story’ until traffic and margin stabilize, which we see as several quarters away,” Evercore ISI analyst Michael Montani wrote in a note to clients on Friday, cutting his rating on the stock to in line from outperform. Analysts at Oppenheimer, JPMorgan, Loop Capital Markets and Telsey Advisory Group also downgraded Dollar General to hold-equivalent ratings, while Raymond James cut to outperform from strong buy.

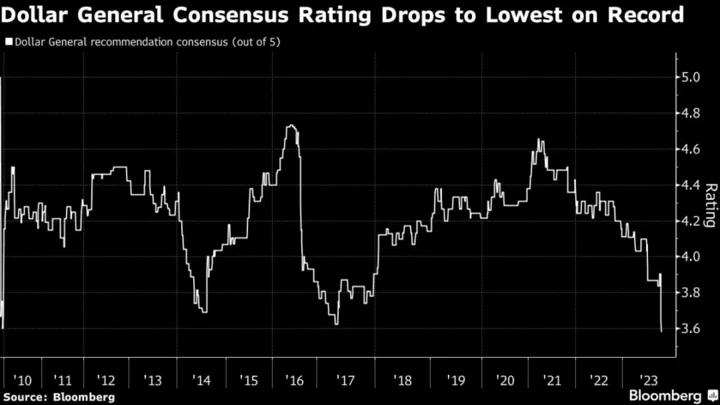

The cuts brought Dollar General’s consensus rating — a proxy for its ratio of buy, hold, and sell ratings — to about 3.58 out of five, the lowest for the retailer since its public debut in late 2009.

Dollar General Chief Executive Officer Jeff Owen said on the retailer’s earnings call that its core customers continue to say that they feel financially constrained and are focused on buying necessities. Earlier this week, a report from benefits software developer Propel Inc. showed that an increasing share of low-income Americans are behind on rent and struggling to afford food.

Read more: Poor Americans Tap Debt, Buy Less Food as Consumer Cracks Widen

Consumers broadly are grappling with elevated borrowing costs and dwindling pandemic-era savings, and this fall, the resumption of student loan payments, too. A Bureau of Labor Statistics report showed Friday that while US hiring picked up in August, wage growth slowed, offering a mixed picture of the labor market.

“It’s a lot of headwinds without a lot of tailwinds,” for the consumer, Patrick Kaser, equity portfolio manager at Brandywine Global Investment Management, said. The Classic Large Cap Value strategy he co-manages is underweight consumer discretionary stocks, he said.

Second-Half Outlook

The signs of a softening consumer environment have US retailers warning that while Americans have proved largely resilient so far, the second half of the year might not look as rosy. Beyond uncertain consumer demand, retailers from Dollar General to Nordstrom Inc. are facing an increase in shrink — an industry term for inventory losses often tied to theft — which stands to further pressure profits.

Read more: Nordstrom Says Theft at Historic High as Retailers Battle Crime

A broad gauge of retail stocks dropped 5.2% in August amid a flurry of earnings reports, while the S&P 500 Index slid 1.8%. The S&P Retail Select Industry Index has underperformed the broader market in 2023 overall.

Still, consumers — and higher-income shoppers in particular — have shown a willingness to spend on popular brands. Abercrombie & Fitch Co., whose shares have more than doubled this year, boosted its annual outlook last week. Lululemon Athletica Inc. rose 6% on Friday after the high-end athleisure company increased its annual projections.

(Updates for market close throughout.)