The second coming of Walt Disney Co.’s Bob Iger has been extended given the challenges he faces — particularly when it comes to restoring the stock market magic of his first tenure.

The entertainment giant’s shares rose nearly sixfold during Iger’s first 15-year stint as chief executive officer through to February 2020. His successor Bob Chapek oversaw a 28% decline during a brief and tumultuous stretch, as the Covid-19 pandemic forced Disney to temporarily shutter theme parks, its film studio and cruise businesses.

So far, the stock is down 6.8% since Iger’s return as CEO in November, while the S&P 500 Index has rallied 14% in that time. Netflix Inc., which competes with Disney directly in streaming, is up 56% and its market capitalization is now leading by the widest margin ever.

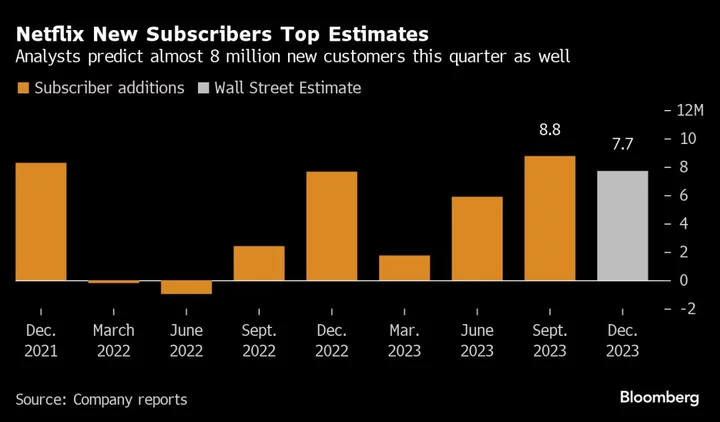

Having once built Disney into the world’s most powerful entertainment company by acquiring the Pixar and Marvel studios along with Star Wars’ Lucasfilm, Iger — whose two-year contract was last week extended by the company through December 2026 — is now slashing spending with cut backs and layoffs, at a time when rival Netflix is adding subscribers again.

“The work that he needed to do wasn’t going to be done in two years. And finding that person who’s going to be able to do that has proved to be a challenge,” Thomas Martin, senior portfolio manager at Globalt Investments said in an interview. “So why not stick with somebody who has that kind of experience and feel.”

Big stock gains for storied CEOs returning for a second tour are far from certain, but there are some high-profile successes — Starbucks Corp. shares rallied more than 500% in Howard Schultz’s second term after he returned to steer the coffee-shop operator out of the financial crisis.

Bob Iger Shifts From Building an Empire to a Disney Yard Sale

While Apple Inc.’s late co-founder Steve Jobs was not CEO when he was ousted from the technology giant in 1985, his return in 2000 led to a 1,300% stock gain under his leadership — turning it into one of the world’s most valuable companies by the time he stepped down.

On the flipside, Michael Dell, who created one of the world’s biggest personal-computer companies out of his college dorm room, came back as top boss in 2007. The shares continued to lag under him, until he took the firm private in 2013.

For investors, Iger staying until 2026 provides “higher signal quality regarding Disney’s path,” said Laura Martin, an analyst at Needham & Co., noting that this provided a “reasonable investment timeframe.”

Iger’s extension also gives the 72-year-old more time to find his successor, and he’s expected to need it.

“I think it was easy to say in hindsight that the first two years wasn’t going to be enough,” said Globalt’s Martin. “And so now is the next two years going to be enough? The short answer is probably not. They’re probably going to need more time.”

Tech Chart of the Day

While the Nasdaq 100 Index has surged 44% this year, some stocks completely missed the rally. Shares of the largest telecommunications companies, including T-Mobile Us Inc., Verizon Communications Inc. and AT&T Inc. are all down this year. AT&T is the worst performer in the group, slumping 11% in the last two sessions, amid concerns over potentially high costs it could face if it has to clean up contamination due to lead-clad wiring throughout its nationwide network. The stocks were mixed on Tuesday, while the Nasdaq 100 fell 0.6%.

Top Tech Stories

- Microsoft Corp. and Activision Blizzard Inc. are nearing the finish line on their $69 billion deal, but aren’t likely to close it by a Tuesday deadline, people familiar said.

- At a hearing on Monday, Britain’s Competition Appeal Tribunal “conditionally” paused a fight against a proposed ban on the deal handed down earlier this year by the Competition and Markets Authority (CMA), the UK’s competition regulator.

- Meta Platforms Inc. faces the Nasdaq 100 Index “special rebalance” cut even though the social media giant missed a crucial threshold for downsizing.

- This year’s rally in the global semiconductor stocks may be set for a reality check as ASML Holding NV kicks off the sector’s earnings season with insights into industry investment plans.

- Chinese-owned online retailer Temu sued rival Shein in the US, alleging it violated antitrust laws by using threats and intimidation to block clothing manufacturers from working with the fast-rising upstart.

--With assistance from Tom Contiliano.

(Updates to adds stock moves in Tech Chart of the Day section.)