Chinese developer Country Garden Holdings Co. won approval from creditors to extend a maturing yuan bond, helping avoid a first-time default and bringing some respite amid a liquidity crisis that’s shaken the nation’s financial markets.

The company received sufficient support in a vote that ended late Friday to stretch payments on the 3.9 billion yuan ($537 million) of outstanding principal into 2026, according to filings to the Shanghai Stock Exchange’s private disclosure platform that were seen by Bloomberg News. The security has a Sept. 2 maturity, which means it effectively falls due Sept. 4, the next business day.

Country Garden also won approval to add a grace period of 40 calendar days, the filings show. Separate proposals from a small group of holders that the security be declared in default because of a recent downgrade and that full payment be made upon maturity were not passed.

As China’s broader property debt crisis heads into its fourth year, tests are far from over for Country Garden, formerly the nation’s biggest developer. More debt deadlines loom for the builder that has about $187 billion of total liabilities.

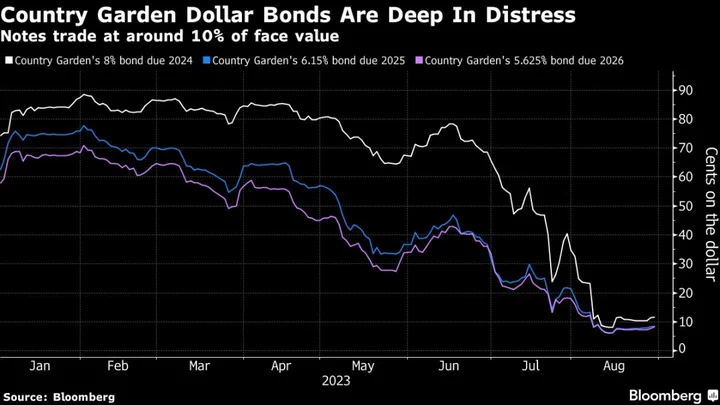

It must pay a combined $22.5 million in two dollar note coupons within a grace period that ends Sept. 5-6 or risk default. Markets were jolted when it missed the initial deadline for those payments last month, with Chinese junk dollar bonds—largely issued by builders—falling to their lowest levels this year.

Country Garden didn’t immediately offer a comment when reached after office hours.

Helmed by one of China’s richest women, Yang Huiyan, the builder is important to the nation’s economy due to its sheer size, with more than 3,000 housing projects in smaller cities and about 70,000 employees.

That status had given Country Garden the firepower to withstand an industry cash crunch that led to record defaults since China Evergrande Group first missed bond payments in 2021. But an industry slump is threatening that streak. Any stumble by Country Garden, now China’s sixth-largest builder by contracted sales, risks worse fallout than from Evergrande given it has quadruple the property projects.

Earlier Friday, two holders of Country Garden’s yuan bond said they’d received interest. The company’s proposed principal extension plan doesn’t involve the coupon payment effectively due Monday.

The developer recently posted an unprecedented net loss of 48.9 billion yuan for the first half of the year and warned of possible default.

China’s private-sector developers like Country Garden are grappling with an unprecedented crisis, after a government effort to curtail debt-fueled growth and housing speculation led to cash crunches. Officials have attempted myriad efforts to stoke demand for the property market — which along with related industries accounts for about 20% of the economy. In recent days, authorities announced fresh stimulus for the beleaguered property sector.

Country Garden’s troubles have intensified the past few months as it stares down as much as $2.9 billion of note obligations the rest of this year. Meanwhile, attributable sales through July fell 35%.

Here’s a calendar of Country Garden bond principal and interest payments across currencies still due in September. It excludes payments under grace period:

--With assistance from Emma Dong.

(Adds further details on the voting outcome for other proposals)