By Amina Niasse

NEW YORK (Reuters) -Pending home sales fell in October to the lowest since at least 2001, indicating the month's high mortgage rates and weakened affordability kept potential buyers on the sidelines, according to a report released on Thursday.

Contracts to buy existing homes fell 1.5% in October to 71.4 from a revised 72.5 the month prior, according to the National Association of Realtors' Pending Home Sales Index. That was the lowest since NAR launched the index in 2001.

Economists polled by Reuters expected a decline of 2.0%.

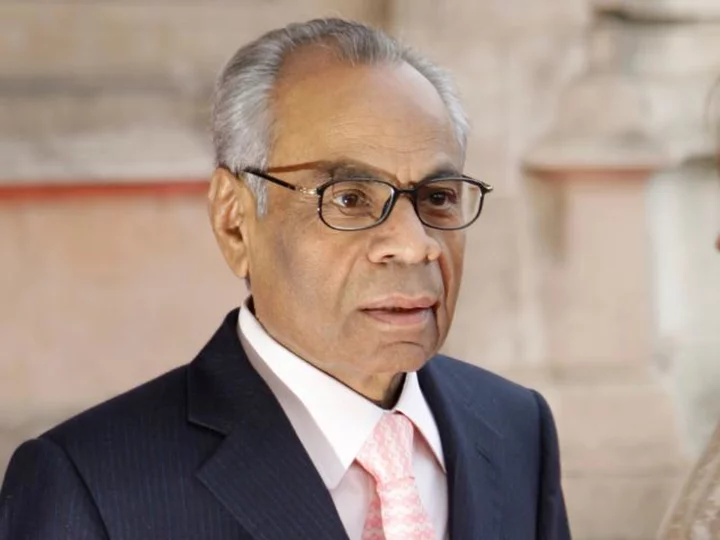

“During October, mortgage rates were at their highest, and contract signings for existing homes were at their lowest in more than 20 years,” said Lawrence Yun, the NAR's chief economist. “Recent weeks’ successive declines in mortgage rates will help qualify more home buyers, but limited housing inventory is significantly preventing housing demand from fully being satisfied. Multiple offers, of course, yield only one winner, with the rest left to continue their search.”

Contracts on existing homes fell by the most in the West and South on a monthly basis. Contracts signed rose by 2.7% in the Northeast, the only region to experience a month-over-month increase.

Pending home sales have declined 8.5% on a yearly basis. The fall accompanies declining affordability for homebuyers with the average monthly mortgage cost rising to $2,199 in October from $2,155 in September, according to a survey released by the Mortgage Bankers Association.

Recent readings of the job market and inflation show but have cooled, easing pressure on the Federal Reserve in its bid to curb inflation. After the Fed refrained from raising its policy benchmark again in November, the bond yields that influence home loan rates have declined sharply, bringing the 30-year average fixed rate mortgage to 7.37% last week by the MBA's measure, down from a two-decade high near 8% in mid-October.

A separate survey from Freddie Mac shows rates have fallen even further. As of Thursday, they had dropped for a fifth consecutive week to 7.22%, the lowest in more than two months.

While mortgage rates may be declining, the median sales price on an existing home rose 3.4% in October from a year earlier to $391,800. Completed transactions for existing homes fell to their lowest in more than 13 years in October, NAR said last week.

(Reporting by Amina Niasse;Editing by Chizu Nomiyama and Dan Burns)