Mankind Pharma Ltd. is set to start trading in Mumbai on Tuesday after raising 43.3 billion rupees ($529 million) in one of India’s largest initial public offerings of the year.

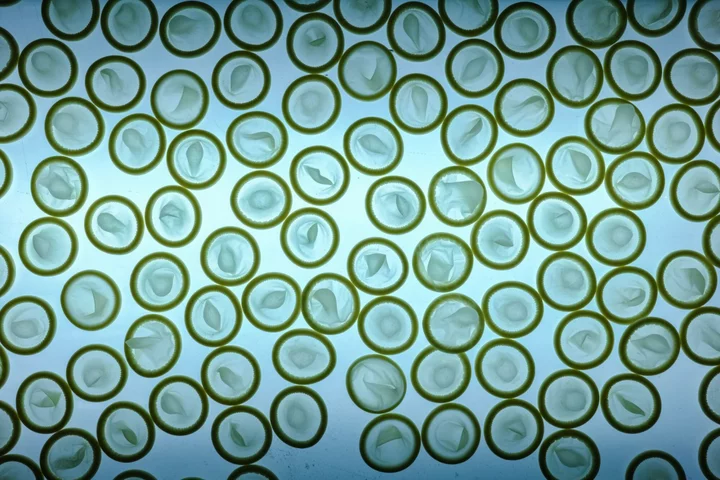

Shareholders of the drug and contraceptive maker sold 40 million shares at 1,080 rupees apiece, the top of a marketed range that started from 1,026 rupees. Anchor investors like Canada Pension Plan Investment Board, Government of Singapore and Abu Dhabi Investment Authority together subscribed to nearly 13 billion rupees worth of shares. The company didn’t sell any new stock.

The Mankind deal marks the return of mid-to-large-sized debuts in India. It will be closely watched as its performance may be an indication of appetite for new share sales in the South Asian nation, following a 13% drop in year-to-date IPO proceeds compared to the same period in 2022. India’s benchmark NSE Nifty 50 Index is outperforming a broader gauge of emerging-market equities this quarter.

READ: Foreign Funds Flock to India as China Rally Flops: Taking Stock

Excluding offerings by real estate investment trusts, the IPO is India’s biggest since Delhivery Ltd.’s listing about a year ago. Over the past five years, Mumbai listings larger than $500 million have on average declined 8.2% in their first day of trading, data compiled by Bloomberg show.

Reception to Mankind will set the tone for upcoming listings of about similar size including from real estate investment trust Nexus Select Trust and stationary company Doms Industries.

Founders of Mankind and affiliates of private equity investors Capital International Group and ChrysCapital sold their shares in the IPO. Kotak Mahindra Capital Co., IIFL Securities Ltd., Jefferies India and JPMorgan India arranged the offering.

READ: India Passes China as World’s Most Populous Nation, UN Says

--With assistance from Paresh Jatakia.