China’s property sector risks are under control, central bank Governor Pan Gongsheng said, amid heightened concern over the financial health of another major developer in the troubled industry.

“We’re closely watching financial risks in certain sectors,” Pan said in an interview with state broadcaster China Central Television published on Friday. “Overall, financial risks of the property sector are manageable.”

He also pointed to strong demand among families for better homes as a factor supporting the real estate market’s long-term growth.

The comments underscore efforts by Chinese authorities to ease market worries over the property crisis, which is hindering an economic rebound. China Vanke Co., the country’s second-largest developer by contracted sales, said earlier this week it would repay its debts on time after getting signals of support from a local regulator and its biggest shareholder.

See: China Builder Vanke Gets Support From Regulator, Biggest Holder

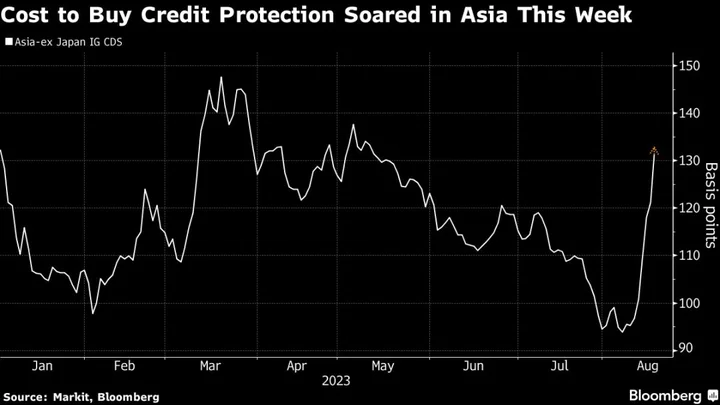

Recent debt troubles at China Evergrande Group and Country Garden Holdings Co., both of which were previously the nation’s biggest builder, have weighed on sentiment as new-home sales continue to fall. On Tuesday, the People’s Bank of China held a seminar with other regulators and major builders, Shanghai-based media outlet Cailian reported.

Beijing is also paying attention to certain regions’ government debt risks, Pan said, without identifying any locales. Those governments need to shoulder their responsibilities and make all efforts to reduce the size of their burden, he said. Earlier this week, Pan vowed necessary emergency liquidity support to some areas.

More: China Should Boost Supervision of Capital Market, Paper Says

China is providing support including guiding banks to lower the interest on debt held by local authorities, Pan said in the CCTV interview. He also reiterated pledges to prevent “over adjustment” of the yuan exchange rate, as well as to maintain a reasonable growth in money and credit.

China’s post-pandemic economy recovered slower than expected earlier this year, partly due to the continued property slump. A decline in land sale income for local governments added to the pandemic’s blow to their finances, resulting in weaker fiscal spending that further weighed on growth.

China is likely to let the central government borrow more while local authorities stabilize their borrowing in an effort to optimize the debt structure, said Tommy Xie, an economist at Oversea-Chinese Banking Corp Ltd. While that’s beyond the central bank’s mandates, the solution will likely lead to higher government bond issuance that requires support from the monetary policy to be absorbed, he said.

“We anticipate the PBOC will intervene to bolster China’s proactive fiscal stance through a more accommodative monetary policy,” said Xie.

(Updates with additional details in final four paragraphs.)