China’s labor market is weak and dragging on confidence in the world’s second-largest economy, alternative data show, contrasting with official gauges of employment suggesting a steady jobs picture.

Independent analysis of online job listings and official economic and household surveys indicate the nation’s job market worsened in the third quarter of the year, with some showing softness stretching into October and November. Consumer confidence remains muted and Chinese companies are offering new hires lower salaries.

That’s despite China’s official urban unemployment rate holding steady in October from the previous month at 5%, although down from 5.5% at the start of the year.

The diverging narratives in the official and alternative data reflect concerns among economists that the jobless rate reported by China’s National Bureau of Statistics fails to reflect the overall situation. The figures also illustrate the entrenched weakness in consumer confidence and are likely contributing to the nation’s deflationary pressures, underscoring a key challenge to economic growth.

“The official urban unemployment rate no longer reflects the difficulties in the job market,” said Dan Wang, chief economist at Hang Seng Bank China Ltd.

Data Limitations

One of the alternative data sources from Paris-based QuantCube Technology is an employment indicator based on online job listings. Since July, that gauge has remained more than 40% below last year’s level.

That suggests “the job market in China is currently experiencing significant weakness and showing no signs of recent recovery,” said Thanh-Long Huynh, chief executive officer of QuantCube.

Economists have pointed to a number of flaws in the official headline unemployment rate that limit its usefulness as an indicator of overall labor market conditions: It covers only urban areas, and may leave out some migrant workers.

“Under-employment has become a real issue for China, and also a new one,” said Wang of Hang Seng Bank. She cited as examples people who settle for part-time jobs, along with migrants who have left cities and returned to rural areas to seek work.

Official job market data has also become less detailed this year. China stopped publishing unemployment rates for different age groups — including the youth jobless rate — this summer, saying the series were flawed. A quarterly central bank survey of households’ outlook for jobs hasn’t been updated since June, without explanation.

Deflationary Pressures

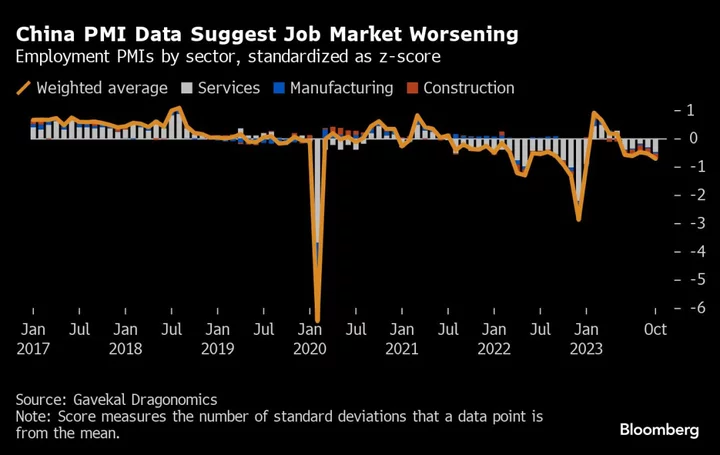

Another job market indicator developed by Gavekal Dragonomics — which is based on China’s official purchasing managers’ indexes — was negative throughout the third quarter, and worsened in October.

“Confidence recovered a bit in early 2023’s reopening, but then fell back, indicating households remain very uncertain about the economic and employment outlook,” said Ernan Cui, consumer analyst at Gavekal.

Official data suggests deflationary pressures persist: Consumer prices fell in October from a year earlier. A cold labor market is generally seen as a source of deflation, since high unemployment pushes down wages, thereby reducing demand and consumer prices.

“The current pace of core CPI inflation remains very subdued compared to previous periods of similarly low unemployment,” Cui said. “This reinforces the conclusion that the situation is worse than the headline rate indicates.”

A weakening labor market also weighed on consumer confidence in the third quarter, according to a survey of Shanghai residents published by the Shanghai University of Finance and Economics. The survey’s employment conditions index contracted for the first time this year.

Lower Wages

Lower wages being offered to new hires by Chinese companies add to the difficult picture. Average salaries offered in major cities in China fell 0.5% year-on-year in the third quarter, according to data from online recruitment service Zhaopin Ltd. That marked the first two successive quarters of decline in data going back to 2016.

Entry level salaries have been falling even in sectors such as hi-tech manufacturing and information technology, according to data from the Caixin BBD New Economy Index. Salaries in October averaged 13,757 yuan ($1,925.4) in that index, down 3.2% from the same month a year earlier.

Wage growth is increasingly important for driving consumer spending in China. That’s because the boost to consumption from falling household savings rates following the end of strict coronavirus measures is waning, with savings rates close to pre-pandemic levels.

Consumer focused companies have pointed out a weakness in demand, with some focusing on lower-cost offerings as a result. McDonald’s Corp. has responded to “historically low consumer sentiment” in China by focusing on lower-priced burger deals, Chief Financial Officer Ian Borden said in an earnings call last month.

“Since late September, we have observed softening demand, which extended to October,” said Andy Yeung, chief financial officer of Yum China Holdings Inc., in an earnings call. The company operates KFC and Pizza Hut restaurants in the country. “Consumers have become more value conscious.”

After government steps to support China’s economic recovery, some momentum has been sustained: Economists now widely see growth hitting or surpassing an official goal of around 5% for 2023.

But the job situation appears to lag behind overall growth, said Robert Wu, CEO of BigOne Lab, which tracks online job postings.

“It may take an extended period of recovery in broader industries for companies to have more confidence to start hiring more,” he added.

--With assistance from Yujing Liu.