China needs to offer more support in the short term to keep growth on track while better protecting the private sector over the long run to avoid plunging into a “lost decade” like Japan did in the 1990s.

“Right now, Chinese entrepreneurs are lying low or lying flat. Sentiment is weak,” Fred Hu, founder and chief executive officer at Primavera Capital Group, said at the Bloomberg New Economy Forum in Singapore on Wednesday. “People are not certain whether the leadership is committed to the kind of reforms that China has benefited from so much.”

Hu was speaking on a panel about “Japanification,” or the risk that China will fall into a similar state of prolonged low economic growth. The comparison gained traction this year after Richard Koo, chief economist at Nomura Research Institute, warned that China is experiencing a “balance-sheet recession” akin to Japan’s in which households and companies avoid borrowing or investing and focus on paying down debt.

Many economists have pushed back against broad comparisons between the two. While it’s now the world’s second-largest economy, China has far lower per capita GDP than Japan did when it experienced its slowdown.

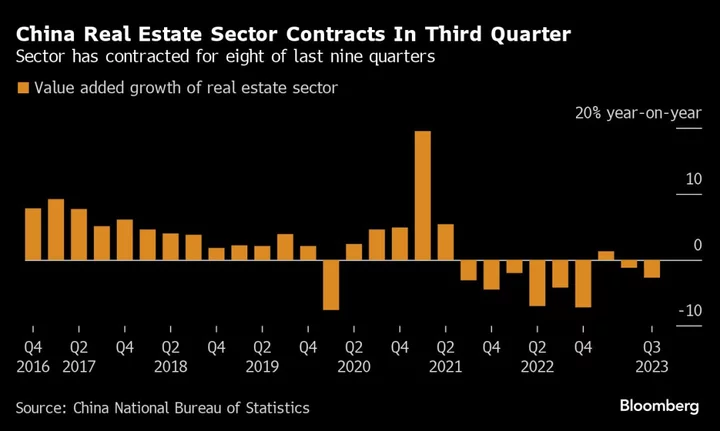

Hu pointed to China’s daunting challenges, particularly from the ongoing property crisis — a saga he said “is still unfolding.”

“I don’t see the end anytime soon,” Hu said, adding that China’s real estate woes are “quite different” from what the US experienced in the run-up to the global financial crisis. “I think it’s a multi-year process — it’s more like in Japan, the real estate crisis in Japan in the 1990s. A slow-motion crisis. So China will have to deal with this problem for at least a few more years to come.”

Others on the panel noted several differences between the two economies.

“China has a bigger economy and more diversity in terms of the composition of the economy, the macroeconomic structure and the depth,” said Benjamin Deng, chief investment officer at Ping An Insurance Group Co.

In the near term, Deng suggested Chinese policymakers still have room to adjust monetary policy. “Looking at interest rate level in China, it’s lower but it’s not low enough.”

On the property front, he sees each part of the market emerging from the crisis differently: While traditional residential housing “could have a long trough,” Deng said rental property is “really trendy.”

China’s entrepreneurial environment was flagged as a major differentiator — if the government is willing to support that sector.

Unlike Japan, “China has been entrepreneurially driven for the past 20 years,” said Gary Rieschel, founding managing partner at Qiming Venture Partners. “The innovation economy in China is quite robust.”

Hu said “far-reaching” structural reforms will be more crucial for growth and development than conventional policy easing for fostering innovation. He singled out legal reform as the “biggest priority,” stressing the importance of protecting entrepreneurs from “arbitrary political interference and worse, even prosecution.”

“This sense of insecurity, in my observation, in the Chinese entrepreneur community, really I have not seen it like this since 1978,” Hu said, referring to the years just after the death of leader Mao Zedong and before China embarked on a series of broad economic reforms.

If China “really commits to rule of law and market reforms, I do think the confidence will slowly but surely come back, then the animal spirit will be rekindled.”

--With assistance from Zibang Xiao.