China will just about meet its economic growth target of around 5% for this year, the latest Bloomberg survey shows, although the ongoing property crisis is raising the risk of a miss.

The economy is projected to expand 5% in 2023, according to the median estimate in a new Bloomberg survey of 78 economists — a 10 basis point-downgrade from an earlier poll, with analysts citing property as the biggest challenge for the nation.

“The real estate sector will continue to be under mounting pressure” despite recent government efforts to support property, said analysts at Poseidon Partner, a Hong Kong-based investment firm. “We expect to see players who racked up debt in the past to continue to suffer.”

The economist survey coincides with new research from Bloomberg Economics that suggests the “around 5%” growth goal is still possible, though not a sure bet. They estimate the probability of an undershoot at 18%.

“The drag from the property slump, fragile sentiment and widespread debt stress in the corporate sector could well knock the economy onto a lower trajectory,” wrote economists Chang Shu and Andrej Sokol in the Tuesday report. They project gross domestic product will expand 5.4% this year.

HSBC Holdings Plc, Morgan Stanley and Citigroup Inc. are already predicting growth of under 5% this year, with HSBC cutting its forecast this week to 4.9% from 5.3%.

Data from August signaled some of the drags on the economy may be bottoming out, with the drop in exports easing and official surveys of manufacturing activity edging closer to the line above which indicates expansion. Credit also grew more than expected, potentially suggesting some stability in household demand for mortgages as authorities work to bolster the real estate market.

The upside surprise from those figures has lowered the probability that China misses its official growth target from 32% in July to less than a fifth in August, according to Bloomberg Economics. But there’s still uncertainty, especially when it comes to the housing market. A housing rally in the nation’s biggest cities has already lost momentum, according to home sales data.

“Targeted support has yet to filter through more convincingly into the property market data,” said Arjen van Dijkhuizen, senior economist at ABN Amro.

The property crisis is by far China’s biggest challenge, according to a separate survey. Seventeen of the 21 economists polled by Bloomberg named “real estate” as the top issue. Three mentioned the economic slowdown, while the remaining respondent pointed to a confidence crisis in the nation.

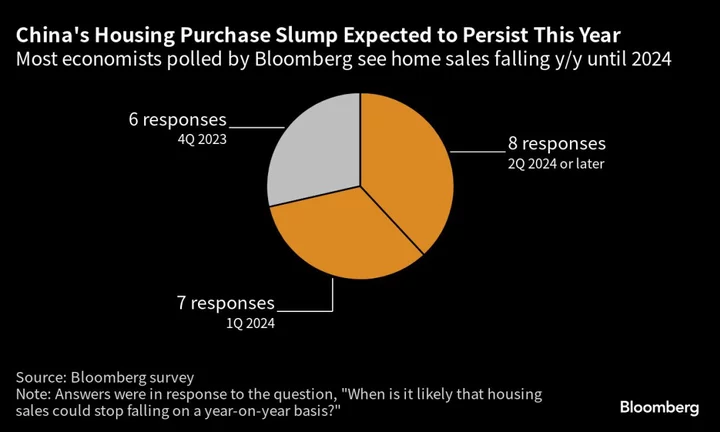

Asked about an ongoing slump in housing sales, 15 of the 21 economists in that survey said they think home purchases will continue falling until at least the beginning of next year.

The property market could take as long as a year to recover, former central bank adviser Li Daokui said, urging Beijing to do more to encourage lending to developers to halt the spread of defaults. While sales in large cities could return to growth sooner, it may take as much as a year to record “good recovery” in smaller cities, Li told Bloomberg News recently.

“The drag from property has yet to fully abate, while external weakness will continue for some time,” HSBC economists including Jing Liu wrote in a research note this week explaining their downgrade.

“To prevent exacerbating structural imbalances, policymakers are refraining from unleashing a ‘sugar rush’ of policy support,” they added. “That said, fiscal and monetary support measures continue to be implemented, but will likely need time to have a larger impact.”

Other findings from the Bloomberg survey:

- China’s GDP is seen expanding 4.3% y/y in the third quarter and 4.8% y/y in the fourth quarter of 2023, each slightly lower than the prior poll

- Forecast for growth in 2024 unchanged at a 4.5% y/y expansion

- Economists still see China’s one and five-year loan prime rates being cut by 10 basis points this year

- Forecast for 10 basis points worth of trims on the central bank’s one-year medium term lending facility rate before the end of the year remained unchanged

- Producer prices expected to contract 2.9% for the full year, a slight improvement from an estimate of a 3% decline in the prior survey

- Exports are likely to fall 4.2% in 2023, compared with an estimated 3% drop in the last poll

- Imports seen declining 5.6% this year, no change from the previous projection

--With assistance from Tom Hancock.