China allowed large cities to cut down payments for homebuyers and encouraged lenders to lower rates on existing mortgages in its latest attempts to halt a slide in the country’s residential property market.

The nationwide minimum down payment will be 20% for first-time buyers and 30% for second-time purchasers, according to a joint statement from the People’s Bank of China and National Administration of Financial Regulation on Thursday. The mortgage-rate cuts will be negotiated between banks and customers. Both policies go into effect Sept. 25.

China is accelerating efforts to reverse a real estate downturn that’s threatening to derail growth in the world’s second-largest economy and roil markets. Home sales slumped for a third straight month in August, and one of the country’s biggest developers is on the brink of default.

Beijing is betting that lower mortgage rates and down payments will revive demand for homes. Down payments vary by city, but can be as high as 80% for a second-time buyer in the capital. More than a dozen larger cities in China currently set the minimum on new homes at 30% or higher, according to Huatai Securities.

In a separate move, at least four banks including Industrial and Commercial Bank of China Ltd. and Agricultural Bank of China Ltd. cut deposit rates in a bid to spur consumer spending, drive more funds into the stock market and alleviate pressure on lenders’ profits.

“The entire package is a step in the right direction — these are stabilizing measures, and will help confidence from sliding further,” said Kelvin Lam, a China economist at Pantheon Macroeconomics.

Read more: China Banks to Cut Mortgage, Deposit Rates in Stimulus Bid (1)

Read more: Everything China Is Doing to Juice Its Flagging Economy

The announcements came as data showed China’s two-year property slump worsened this month. Sales by the country’s 100 largest property developers fell 34% from a year earlier, according to the China Real Estate Information Corp. That was the biggest drop in more than a year. Existing policies have failed to revive demand as homebuyers remain deterred by falling prices amid concerns that builders will struggle to finish apartments.

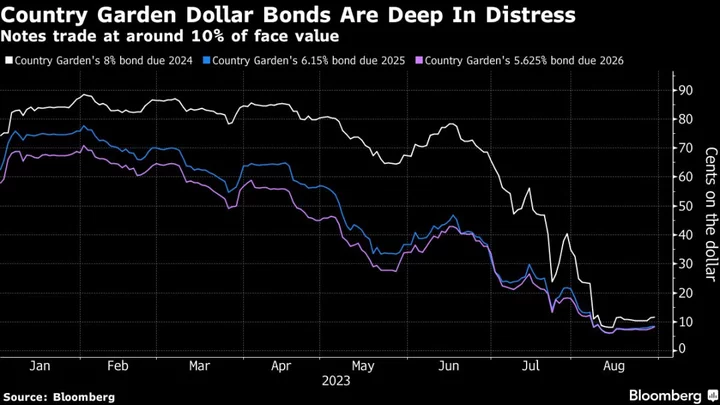

Falling sales have led to mounting financial distress, with giant developer Country Garden Holdings Co. this week posting a record first-half loss of almost $7 billion and warning of possible default. Moody’s Investors Service downgraded the embattled developer three notches Thursday, to Ca. A group of creditors meanwhile is seeking to declare a default on a yuan bond, a fresh complication for a company whose liquidity crisis has shaken the nation’s financial markets.

Read more: China’s Home Sales Drop for a Third Month as Slowdown Deepens

Country Garden missed $22.5 million of dollar-bond coupons earlier this month, dragging the broader Chinese junk dollar debt market to its lowest levels this year. It must repay within a separate grace period that ends next week to avoid default.

Despite risks spreading to the country’s $60 trillion financial system, officials have refrained from resorting to a large-scale bailout for the industry, spurring broader economic concerns and putting the government’s 5% growth target for the year at risk.

While China has reduced benchmark interest rates, guiding down the cost of new mortgages, most Chinese households haven’t seen a benefit, as banks don’t typically reprice existing loans until the beginning of the year. The new guidelines are expected to be adopted by the nation’s big banks.

Bloomberg reported the plan to cut rates on existing mortgages — the first such step since 2009 — earlier this week. The cut could lift gross domestic product growth by 0.1 to 0.2 percentage points by boosting household spending, Bloomberg Economics estimated.

The floor for lowered mortgage rates should be set at the local rate for first-time home purchases by preferred customers at the time the home was bought, the regulators said.

“The reduction in the interest rate of existing housing loans can save interest expenses for borrowers, which helps expand consumption and investment,” the regulators said.

Read More: China Mortgage Rate Cuts Fall Short of ‘Game Changer’ Policy

Local governments will set their own down-payment thresholds and interest-rate floors according to regional market conditions, the national regulators said Thursday. Since 2016, Beijing allowed some cities to set their ratio lower than 30% for first homes, but these tended to be smaller cities and the policy wasn’t rolled out nationwide. The new stance effectively ends the distinction between cities with sales restrictions and those without, the regulators said.

Mortgage rates were falling even before this latest move. As of June, 100 out of 343 Chinese cities have lowered the floor new home loans — or removed the minimum required — the PBOC said in its latest quarterly monetary policy report. That brought the nation’s average to 4.11% in June, down 0.51 percentage point from a year earlier. By contrast, rates in the US have surged to more than 7%.

Last week, the central government allowed local governments to scrap a rule that had disqualified people who’ve ever had a mortgage — even if fully repaid — from being considered a first-time homebuyer in major cities, making it cheaper for families to buy new homes. At least four major cities have since adopted it, including Shenzhen and Guangzhou in the south.

--With assistance from Emma Dong.

(Updates with deposit rate cuts in the fifth paragraph)

Author: Tom Hancock, Li Liu and Evelyn Yu