Raising Cane’s Restaurants has grown to more than 750 locations worldwide, drawing lines when its flagship Times Square store opened in New York this summer.

The craving for its chicken fingers, toast and sauce has spurred a celebrity partnership with rapper Post Malone, while its success has given founder Todd Graves a new title: multibillionaire.

Graves, 51, maintains an ownership interest of almost 90% in the closely held business, bond offering documents reviewed by Bloomberg show. That stake, along with dividends he’s received, are worth $7.6 billion, according to the Bloomberg Billionaires Index, making him the richest person in Louisiana and the 307th-wealthiest in the world.

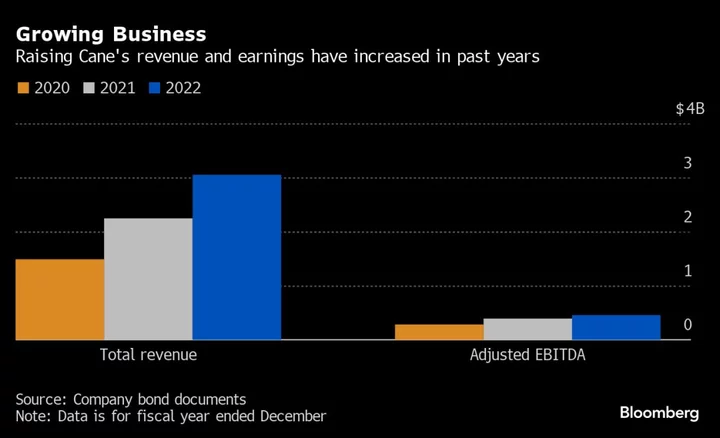

Raising Cane’s is a growing player in the popular chicken category, a competitive market featuring brands like McDonald’s Corp., Restaurant Brands International Inc.-owned Popeyes and Yum! Brands Inc.’s KFC. The Baton Rouge-based company is thriving financially, reporting $3.3 billion in sales for the 12 months ended in June and adjusted earnings of $647 million.

The fast-casual restaurant, which has said it’s looking to reach $10 billion in annual sales by the end of the decade, paid total dividends of $183 million in fiscal years 2020 to 2022, according to documents reviewed by Bloomberg.

“We’re singularly focused on chicken finger meals,” AJ Kumaran, Raising Cane’s co-chief executive officer, said in an interview. “That focus allows us to do this better than anyone else.”

Graves opened the first Raising Cane’s on the campus of Louisiana State University in 1996. A Louisiana native, he earlier worked at a California oil refinery and fished for sockeye salmon in Alaska to raise money for his venture. References to that time remain, with the trust that holds his shares called Sockeyes LP. Graves considered calling the restaurant that as well, but instead decided to name it after his dog.

The company expanded to neighboring Texas, now its biggest market, and can be found in 37 states and four Middle Eastern countries. Unlike some other restaurants, franchise royalties make up only a small portion of sales. As of June, there were only 24 franchise restaurants in the US, earning the company $5.5 million in fees over the past 12 months, company documents show.

Aside from running the business, Graves starred in two television shows, including Restaurant Recovery, where he helped struggling business owners bounce back from the effects of the pandemic. Raising Cane’s spent $8.8 million producing the shows in 2020 and 2021, according to bond documents.

The company made its debut in the junk-bond market several weeks ago, selling $500 million of high-yield notes with a 9.375% coupon, tighter than initial expectations that called for a yield as high as 10%. Investors in the secondary market also like the bonds, which last changed hands at 103.5 cents on the dollar, according to pricing source Trace.

“We saw very strong demand from investors right out of the gate,” Kumaran said. “We were oversubscribed in less than 24 hours.”

--With assistance from Daniela Sirtori-Cortina.