Chevron Corp. posted better-than-expected earnings as output in the Permian Basin soared to a record and the oil giant said it waived the mandatory retirement age for Chairman and Chief Executive Officer Mike Wirth.

Though adjusted earnings of $3.08 per share were higher than the Bloomberg consensus, net income dropped to $6 billion, according to a statement Sunday. It’s the fourth-straight quarter of lower results for Chevron, which have fallen to almost half the level of a year earlier when oil prices surged after Russia invaded Ukraine.

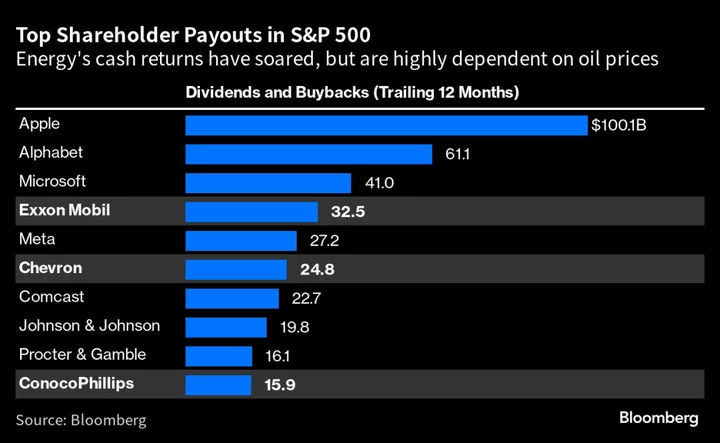

The second-quarter earnings, originally set to be posted July 28, come as Chevron is on a quest for record shareholder returns this year. Other management changes in the surprise announcement included the retirement next year of Chief Financial Officer Pierre Breber.

Wirth, 62, said in an interview that the board asked him to stay around past the usual retirement age of 65 during a “turbulent time” in the markets. There’s “more that I want to do,” Wirth said, adding that he’s “excited to continue.”

Chevron maintained its elevated share buyback despite the lower commodity prices, passing the first real challenge to payout, which it raised multiple times over the last 18 months coming off the back of record earnings. At a rate of $17.5 billion a year, Chevron’s buyback is equal to that of Exxon Mobil Corp., which has a 40% bigger market value.

Still, Chevron stock has languished this year, down 12% through Friday compared with a 4% decline in the S&P 500 Energy Index. Wirth has struggled to persuade investors that Chevron has enough fossil-fuel projects in its locker to maintain targeted annual production growth rates of about 3%. Further, the company was forced to redraw its drilling plan in the Permian Basin earlier this year as wells under-performed expectations. By contrast, rival Exxon has a plethora of growth opportunities.

Wirth attempted to ease some of these concerns by agreeing to buy Colorado-based PDC Energy Inc. for $6.3 billion in stock in May. The goal is to expand Chevron’s operations in the DJ Basin, which Wirth believes can offer high-returns with low risk.

Breber will retire on March 1, 2024, and be succeeded as CFO by Eimear Bonner, currently the vice president and chief technology officer, the company said.

Chevron said in the second quarter it produced the equivalent of 772,000 barrels of oil per day in the Permian Basin of West Texas and New Mexico, registering a new quarterly record for the company in the world’s busiest shale patch.