The Federal Reserve and Bank of England left interest rates unchanged this week, while both left the door open to additional increases should inflation prove persistent.

Policymakers in the US made their decision unanimously, while those in the UK were split. Meantime, Bank of Japan Governor Kazuo Ueda tamped down speculation of a near-term interest rate hike after the central bank chose to stick with its ultra-easy stimulus.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

US

Fed Chair Jerome Powell made clear Wednesday the central bank is close to done raising interest rates, but his colleagues delivered the message that resonated: Borrowing costs must remain higher for longer amid renewed strength in the economy.

US hotels and resorts learned to operate with leaner staffing models during the pandemic. Three years later, Covid-era band-aids like self-service kiosks and less-frequent housekeeping have now become the new normal for many firms seeking to cope with rising labor costs. Nowhere in the US is the fallout more apparent than in Las Vegas, where one in four people are employed in the leisure and hospitality sector.

Europe

The Bank of England halted for now the most aggressive cycle of interest-rate rises in more than three decades as concerns about inflation gave way to signs the economy is slipping into a recession. The decision followed a report that showed UK inflation unexpectedly slowed in August to the lowest level in 18 months.

Britain’s property market has shattered another record with rental costs growing at the fastest pace in at least a decade, while home sellers pushed up asking prices for the first time in four months.

World

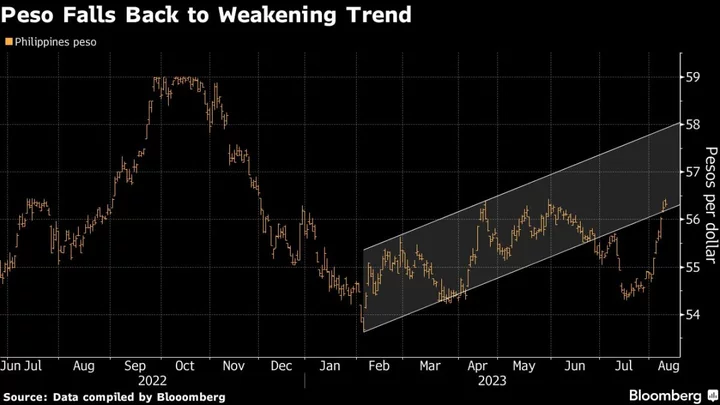

Like the Fed and BOE, the Swiss National Bank refrained from raising rates while cautioning that the battle to contain the price surge had not yet been won. Officials in Turkey, Sweden and Norway hiked while those in Brazil cut rates again. South Africa, Taiwan, Hong Kong, Egypt, the Philippines and Indonesia stayed on hold.

The world economy is set for a slowdown as interest-rate increases weigh on activity and China’s pandemic rebound disappoints. Growth will ease to 2.7% in 2024 after an already “sub-par” expansion of 3% this year, according to the latest OECD forecasts.

Whether the crude spike is just a temporary blip or more enduring is a question that confronted central bankers meeting this week from London to Washington — not least as oil can act both as a spur to consumer prices and a brake on economic growth. That trade-off will test the emerging consensus among officials that inflation risks are contained enough for them to pause tightening for now.

According to BloombergNEF modeling, if the coming winter’s weather follows El Niño patterns in the last decade, gas demand could be 2.2 billion cubic meters less than the base case.

Asia

Japan’s persistently low birthrate and long lifespans have made it the oldest country in the world in terms of the proportion of people aged over 65, which this year hit a record of 29.1%. Similar problems with aging and shrinking populations are spreading across other parts of Asia, with South Korea expected to take over as the world’s grayest nation in the coming decades. China’s population began to shrink in 2022 for the first time in 60 years.

There’s a growing wave of Chinese youth returning to the mainland and eschewing what used to be coveted overseas jobs and foreign citizenship. And while China is facing the world’s biggest exodus of millionaires and growing capital outflows, rising geopolitical tensions and the perception of increasing hostility abroad toward Chinese nationals are changing the calculus.

Emerging Markets

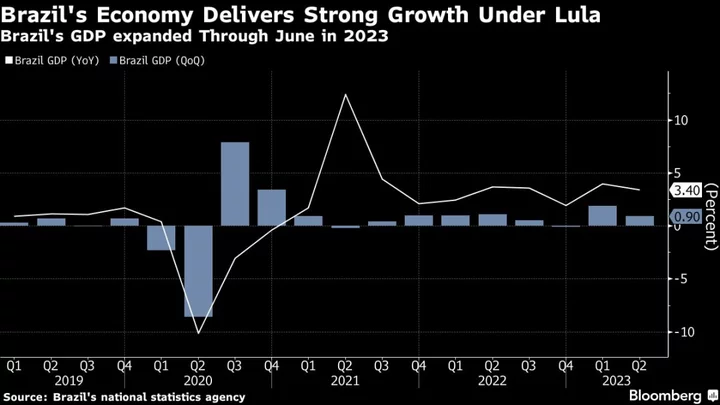

Brazil revised up its 2023 growth forecast following a better-than-expected economic performance in the first half of the year, while keeping inflation estimates unchanged.

--With assistance from Philip Aldrick, Martha Beck, Alice Gledhill, William Horobin, Daniela Li, Jonnelle Marte, Isabel Reynolds, Augusta Saraiva, Zoe Schneeweiss, Jack Sidders, Craig Stirling, Lucy White and Selina Xu.