Cemex SAB’s shares rose as sales beat estimates, even as the company reported a steep drop in profits. The Mexican cement-maker is seeking to lower its debt load and improve its credit rating.

Net income of $126 million in the period was down 75%, less than half the average analyst estimate, after adjusting for an extraordinary gain from the sale of assets last year and higher taxes. Revenue was $4.6 billion, above the average analyst estimate, and up 9% from a year earlier.

Cemex shares rose as much as 4.8% to 11.61 pesos on Thursday, the most since June.

After S&P Global Inc. cut Cemex’s bonds to junk in 2009, the Nuevo Leon-based company launched a strategy to pro-actively manage its liabilities.

“It’s been some time now that we believe we are in the range of our objective of gaining back investment grade,” Chief Executive Officer Fernando Gonzalez said Thursday on a conference call with investors. “The good financial results of this year did accelerate our deleveraging process.”

Cemex’s leverage ratio is 2.16 times, and it seeks to keep it “within investment grade parameters of around 2.5 times,” the CEO said.

The company will refinance $3 billion in bank debt on Oct. 30 and is increasing its committed revolving credit facility to $2 billion, Chief Financial Officer Maher Al-Haffar said on the call. He added that Cemex will continue to tap local debt markets after issuing 6 billion pesos in long-term notes in Mexico — the first time cement maker has tapped Mexican debt capital markets in 15 years.

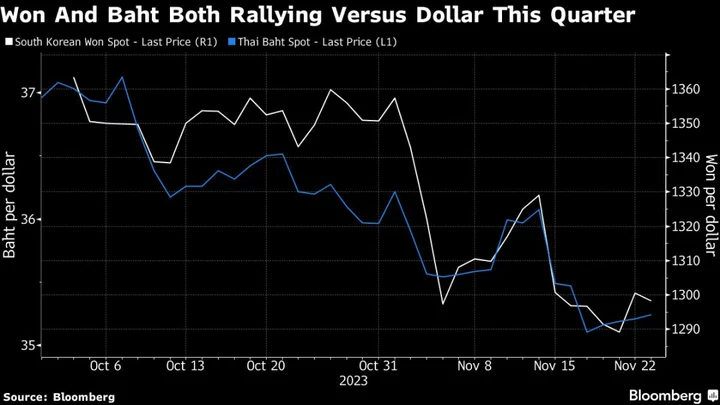

The stronger Mexican peso has helped Cemex reduce debt, 75% of which is denominated in US dollars with another 15% in euros. Cemex’s total debt was $7.49 billion at the end of September, down 8% compared to the same period a year ago.

In August, S&P Global said an upgrade was possible within the next six to 12 months if the company continues to expand profit margins while maintaining financial discipline.

The company is also looking to expand its business in Europe and the US and gradually pull back from emerging markets. As part of that strategy, Cemex is exploring the sale of its unit in the Dominican Republic, Bloomberg reported in September.

(Updates with CEO and CFO comments, plus peso-denominated debt issue, beginning in 5th paragraph.)