A panel tasked with overseeing the credit default swaps market said that the write down of Credit Suisse Group AG’s Additional Tier 1 notes will not trigger an insurance payout.

The Credit Derivatives Determinations Committee (CDDC) ruled at a meeting on Wednesday that the write down would not lead to a payout of the default swaps tied to the bank’s subordinated debt, according to a notice on its website. In reaching its decision, the committee took the view that the AT1 notes were in fact junior to the subordinated bonds underlying the swaps.

The securities had been at the center of a heated market debate. On one side, funds including FourSixThree Capital and Diameter Capital Partners have been buying the default swaps linked to another set of junior Credit Suisse bonds betting that the panel would rule in favor of a payout.

Meanwhile traders and strategists at Citigroup Inc, Barclays Plc and JPMorgan Chase & Co., had been telling their clients that the AT1s were likely to be deemed more junior than the subordinated notes linked to the default swaps, making a payout unlikely.

The 11 members of the committee, including major banks and funds such as Citadel LP, all voted in favor of dismissing the question as a trigger for the swaps. Credit Suisse Group AG, one the members of the committee as of April 29, wasn’t part of the deliberations, according to the statement.

The underlying obligation referenced by the market participant who submitted the question was a sterling-denominated bond issued 23 years ago and matured in 2020. The panel ruled that the holders of these bonds were “priority creditors” versus the AT1 holders and as such the AT1 notes are “excluded obligations” in regards to the swaps.

Total outstanding default swaps tied to Credit Suisse Group AG’s debt amounted to $19.6 billion of gross notional volume as of May 5, according to data from the Depository Trust & Clearing Corporation. The DTCC provides no split between the volume tied to the senior and the subordinated debt of the Swiss lender.

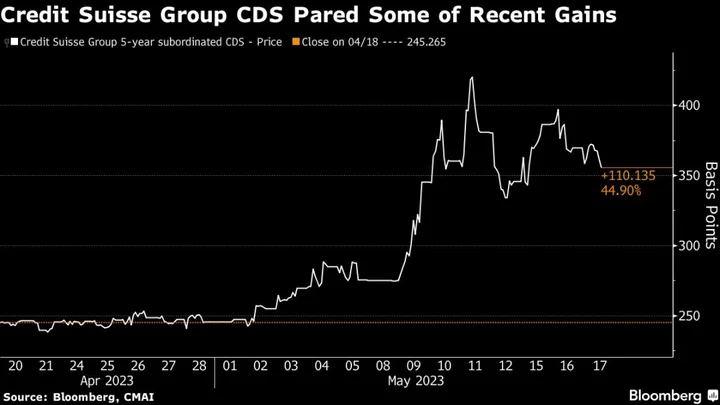

The price of default swaps tied to the bank’s junior debt rose this month before the panel was asked to consider the potential trigger, but have pared some of the gains this week.

--With assistance from Luca Casiraghi.

(Updates with more details on the decision throughout.)