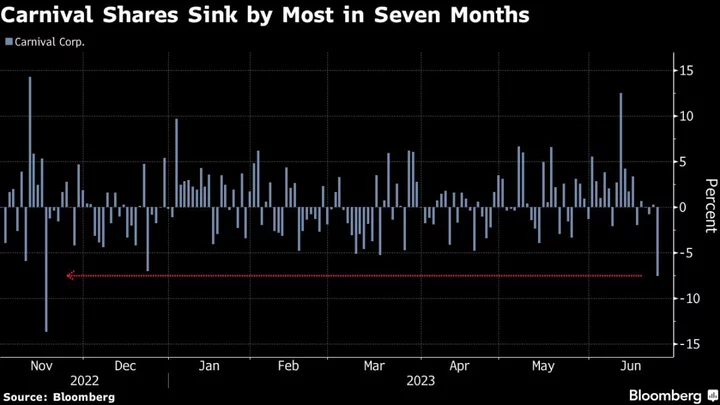

Carnival Corp. shares tumbled by the most in more than seven months after the cruise-ship operator reported quarterly results and an annual forecast that failed to keep pace with the high expectations that had fueled a sharp rally in the stock.

The stock slumped 7.6%, the biggest decline since Nov. 16, after its fiscal second-quarter report.

The results were “solid” and the outlook is rising, Vital Knowledge’s Adam Crisafulli wrote in a note to clients. “The problem for the stock is that a lot of the optimism is already embedded.”

The results came in above analysts’ expectations as the company continues to benefit from the pent-up demand for travel in the aftermath of the pandemic. Its adjusted second-quarter loss per share of 31 cents was smaller than the 34-cent consensus analyst estimate, and revenue more than doubled to $4.9 billion, also surpassing expectations. It also bumped up its forecasts.

But the results weren’t enough to keep up with the torrid rally in the stock that had preceded them. Carnival’s shares had surged 96% this year as of Friday’s close as cruise-ship companies experienced a rebound after the Covid-19 pandemic. Analysts from Bank of America Corp. to JPMorgan Chase & Co. signaled increasing confidence in demand despite the broader uncertainty over the economic outlook. Both BofA and JPMorgan upgraded Carnival’s stock to buy-equivalent ratings earlier this month.

Read more: Soaring Travel Stocks Risk Stalling as Pent-Up Demand Wanes

“This is going to be a classic sell the news type of day for Carnival’s shares,” Stifel analyst Steven Wieczynski said in a note. He added that “faster-money investors” have been riding the stock’s momentum, and after Carnival raised its annual guidance and provided long-term financial targets, “the faster-money investors are probably wondering how much better this name can get in the near-term.”

Carnival’s results came just as its peer Viking Cruises Ltd. is looking to sell $720 million in junk bonds, the cruise ship operator’s first public issuance since 2021. Viking’s 13% notes due in 2025 were issued just a few months into the pandemic. The notes have rallied, changing hands at 105 cents on the dollar, bringing the yield down to 5.56%, according to Trace.

Carnival has about $7.5 billion in debt maturing by the end of 2025, and it plans to use excess liquidity to prepay debt and reduce interest expenses, according to its earnings presentation. Management said it had $7.3 billion in liquidity as of the second quarter, and it plans to reduce its total debt to “less than $33 billion” by the end of 2023 from a peak of $35 billion.

--With assistance from Michael Tobin, Aashna Shah and Dawn McCarty.

(Updates for market close.)