TORONTO--(BUSINESS WIRE)--Jun 8, 2023--

While the major U.S. retail banks and credit card providers have trained their sights on a new generation of personal financial management “super tools” as the next frontier of mobile app and website development, Canadian banks have been slower to adopt these features. According to a series of recent studies of bank and credit card mobile app and online users in Canada, released today by J.D. Power, these digital features that are focused on personal financial management have become the keys to standout customer engagement and customer satisfaction for the handful of banks that have embraced them. However, they have also introduced challenges.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230608005072/en/

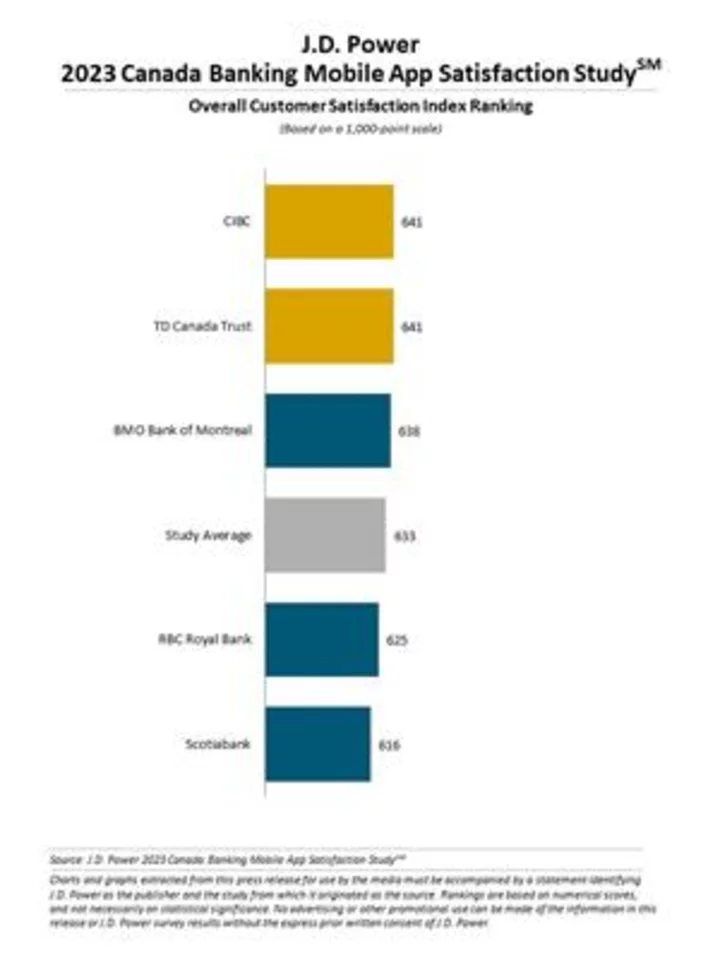

J.D. Power 2023 Canada Banking and Credit Card Mobile App Satisfaction Study

The studies—J.D. Power 2023 Canada Banking Mobile App Satisfaction Study; SM 2023 Canada Online Banking Satisfaction Study; SM 2023 Canada Credit Card Mobile App Satisfaction Study; SM and 2023 Canada Online Credit Card Satisfaction Study SM —track overall customer satisfaction with banking and credit card providers’ digital offerings.

“The trendline is clear,” said Jennifer White, senior director of banking and payments intelligence at J.D. Power. “Banks and credit card providers that position themselves as the hub of their customers’ financial lives—and give them the tools they need to manage everything from a single, easy-to-use interface—are gaining a huge lead in customer satisfaction and customer engagement vs. institutions that have not invested in these tools. Across J.D. Power studies, the gap is widening between the top- and bottom-performing apps and websites as organizations work to find digital solutions that make their customers’ lives easier.”

Following are some key findings of the 2023 studies:

- Basic transactional tools consistently perform better than more advanced features: Banks and credit card mobile apps and websites are receiving substantially higher overall satisfaction scores for basic transactional tools such as account transfer, bill pay, mobile check deposit and person-to-person payments. When it comes to more advanced personal financial management tools such as spending analysis and budgeting tools, many providers struggle to connect with customers.

- Personal financial management tools drive satisfaction—when they are used: When banking app customers actively engage with three or more personal financial management tools, such as credit score monitoring, spending analysis and budgeting tools, overall satisfaction scores rise 114 points (on a 1,000-point scale) vs. when these tools are not offered. The first hurdle to lifting satisfaction with these tools is promoting wider tool use.

- Virtual assistants do heavy lifting on adoption: Customers who use a virtual assistant provided on their banking app are four times more likely to use personal financial management tools.

- Alerts play important role in influencing financial health: Among financially unhealthy 1 customers, account alerts drive a 33-point increase in customer satisfaction with banking mobile apps. Among financially healthy customers, use of account alerts is consistent with a 29-point increase in customer satisfaction.

Study Rankings

CIBC and TD Canada Trust rank highest in a tie in banking mobile app satisfaction, each with a score of 641. BMO Bank of Montreal (638) ranks third.

BMO Bank of Montreal ranks highest in online banking satisfaction with a score of 628. Scotiabank (614) ranks second and RBC Royal Bank (613) ranks third.

American Express ranks highest in credit card mobile app satisfaction with a score of 687. Tangerine Bank (672) ranks second and Canadian Tire (651) ranks third.

American Express and National Bank of Canada rank highest in a tie in online credit card satisfaction, each with a score of 667. Desjardins (652) ranks third.

The Canada Banking Mobile App Satisfaction Study; Canada Online Banking Satisfaction Study; Canada Credit Card Mobile App Satisfaction Study; and Canada Online Credit Card Satisfaction Study were redesigned for 2023. The studies measure overall satisfaction with banking and credit card digital channels based on four factors: navigation; speed; visual appeal; and information/content. The studies are based on responses from 8,242 retail bank and credit card customers and were fielded in February-March 2023.

To learn more about these studies, visit https://www.jdpower.com/business/digital-banking-and-credit-card-studies-platform.

See the online press release at http://www.jdpower.com/pr-id/2023057.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business.

About J.D. Power and Advertising/Promotional Rules:www.jdpower.com/business/about-us/press-release-info

1 J.D. Power measures the financial health of any consumer as a metric combining their spending/savings ratio, creditworthiness, and safety net items like insurance coverage. Consumers are placed on a continuum from healthy to vulnerable.

View source version on businesswire.com:https://www.businesswire.com/news/home/20230608005072/en/

CONTACT: Media Relations Contacts

Gal Wilder, NATIONAL; 416-602-4092;gwilder@national.ca

Geno Effler, J.D. Power; West Coast; 714-621-6224;media.relations@jdpa.com

KEYWORD: MICHIGAN UNITED STATES NORTH AMERICA CANADA

INDUSTRY KEYWORD: BANKING PERSONAL FINANCE TECHNOLOGY PROFESSIONAL SERVICES APPS/APPLICATIONS DATA ANALYTICS SOFTWARE ARTIFICIAL INTELLIGENCE FINTECH MOBILE/WIRELESS FINANCE

SOURCE: J.D. Power

Copyright Business Wire 2023.

PUB: 06/08/2023 06:00 AM/DISC: 06/08/2023 06:01 AM

http://www.businesswire.com/news/home/20230608005072/en