Canaccord Genuity Group Inc. cut bonuses due to a plunge in dealmaking activity and is exploring ways to boost employee stock ownership after a bid to go private failed.

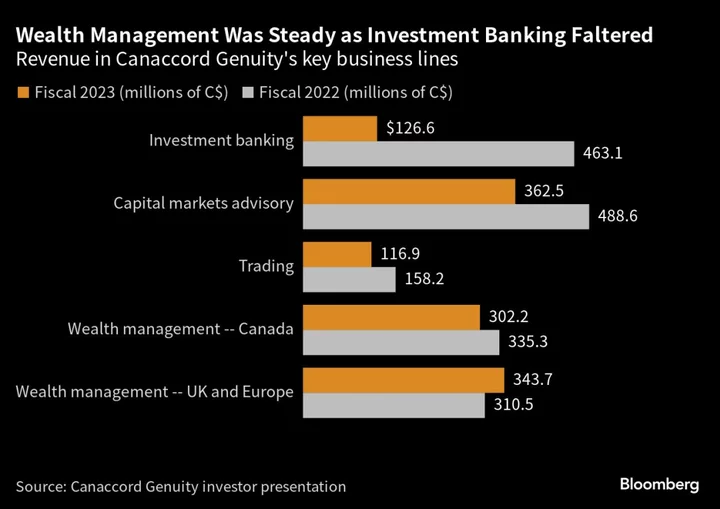

Compensation expenses fell 25% at the Canadian financial firm to C$936.9 million ($709.1 million) in the fiscal year ended March 31, according to disclosures accompanying its fourth-quarter results. New issues dried up in the small- and mid-cap segments that Canaccord serves: The first three months of 2023 were the slowest quarter for initial public offerings in Canada since 2016, according to data compiled by Bloomberg.

Total pay declined 34% in Canaccord’s capital markets division and 8.8% in the wealth-management unit.

Bonus conversations “were difficult, but I think they were difficult throughout the street,” Chief Executive Officer Dan Daviau said in an interview.

Canaccord’s recent financial results for the underscore the challenges facing the firm as it prepares to forge ahead as a public company, months after top executives said it no longer made sense for it to stay listed. The firm’s quarterly revenue of C$430.4 million in the three months ended March was the lowest for that period since 2020, when the Covid pandemic was beginning. Earnings per share fell 87% on an adjusted basis compared with the prior year.

A group of Canaccord executives and employees, led by Daviau and Chairman David Kassie, had offered in January to take the company private for C$11.25 per share, valuing the firm at about C$1.1 billion.

The proposal ran into opposition from the board, where a committee led by director Gillian Denham said it undervalued the company. The situation boiled over in March when Denham and four other directors quit under pressure from a large shareholder, Skky Capital Corp., that wanted the deal.

Then, in May, the transaction hit another obstacle when the company warned it might not be able to get timely approval from regulators of the take-private bid, due to an “ongoing regulatory matter” at one of its foreign divisions. The management group let its offer expire on June 13.

One positive from the bid, Daviau said, was that hundreds of employees expressed an interest in being shareholders of a private Canaccord.

“We’re going to have to figure out how to recreate as many elements of the privatization as we can, being public — including creating a means for our important next generation of employees to be shareholders of our company going forward,” the CEO said. “Equity participation programs and the like are going to be a key priority for the year.”

Shares of Canaccord fell 0.6% to C$8 at 12:34 p.m. in Toronto.