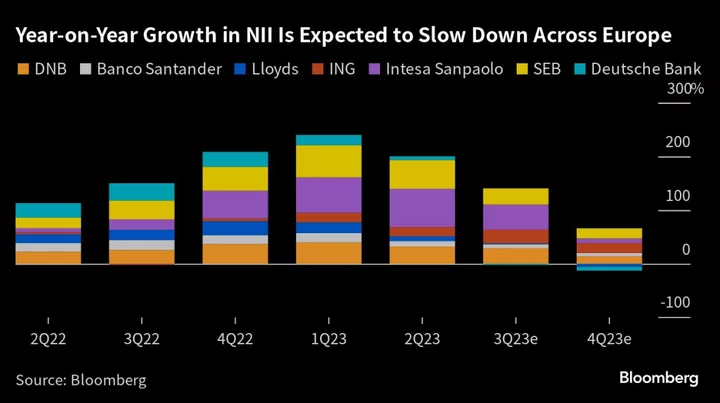

European banks have enjoyed record levels of net interest income over the last year. That’s tempting some governments to try to tax those profits just as the cycle appears to have peaked.

Analysts expect only 2 of Europe’s 20 biggest banks to see their year-on-year NII growth rates — essentially the difference between the interest a lender earns on loans and pays on deposits — continue to accelerate in the third quarter, based on a Bloomberg-compiled consensus.

Five of them might even see it turn negative in the fourth quarter, with the biggest drop of 19.5% expected for Austria’s Raiffeisen Bank, according to analysts.

No lenders missed on this metric during second-quarter earnings, with 75% of European banks exceeding consensus NII expectations, and the remainder in line, according to Bloomberg Intelligence. Such beats are set to become rarer as European banks face increasing political pressure to pass on the interest to savers, the threat of windfall taxes and the prospect of central bank rate hikes coming to an end.

Italy’s unexpected tax on banks’ windfall profits, announced by Deputy Prime Minister Matteo Salvini on Monday, was the latest proposed action across the continent.

Read More: Italian Bank-Tax Confusion Shows the Flaws in Meloni’s Coalition

In Spain, where lenders lag their European counterparts when it comes to passing on interest to clients, banks are quarreling with the country’s socialist leader Pedro Sanchez over his windfall tax on banks and energy companies. The tax could reduce pretax profit in 2023-2024 by as much as 10% for some banks, according to Bloomberg Intelligence.

The Financial Conduct Authority urged UK banks last month to “speed up” their efforts to pass on rate rises to savers and warning of “robust action” if not.

Such interventions will do little to draw investors to the sector.

Rome’s announcement “is yet another arbitrary government move to adversely impact banks at a time when they are finally replenishing capital bases after many years of artificially compressed interest margins,” said Jerry del Missier, founder of Copper Street Capital and a former chief operating officer of Barclays Plc. “It further normalizes a tax that harms the sustainability of domestic banks in Europe for short term political gain.”

Author: Maggie Shiltagh and Chloé Meley