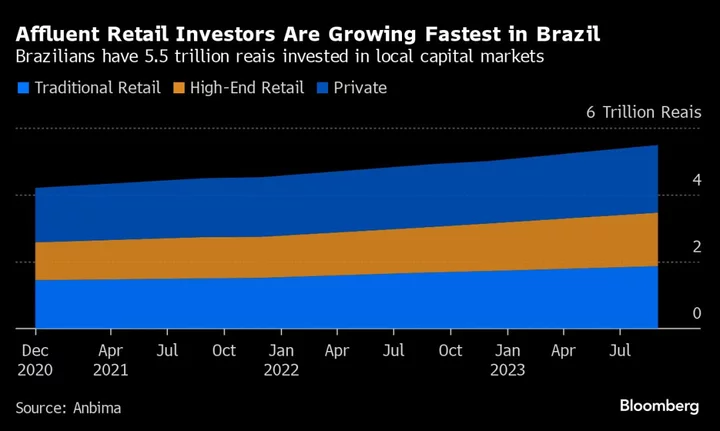

Brazilians had a record 5.5 trillion reais ($1.1 trillion) in domestic financial investments at the end of the third quarter, with the segment of high-net-worth retail customers growing at the fastest pace.

In retail, about 3.5 trillion reais were held in more than 148 million accounts, while private banking had 2 trillion reais under management in 155,300 accounts, according to a report by capital markets association Anbima.

Total investments by high-net-worth retail clients increased 12.3% in the first nine months from the end of 2022, according to Luciane Effting, vice president of investment distribution at Anbima. The private-banking segment expanded 8.5% in the period with traditional retail rising 8.7%. While there’s no ceiling on how much a wealthy retail investor would have, the minimum for private-banking clients in Brazil is usually about 3 million reais, she said.

The figures support the decision by more than 30 firms to begin providing independent wealth-management services in the first half of the year to advise on investment allocations as well as tax and succession planning. The growth has come as the frenzy to open new hedge funds has stalled in a high-interest-rate environment.

Read More: Wealth-Management Firms Multiply in Brazil as Bankers Leave Jobs

“You’re seeing new firms looking at this affluent group, which make bigger investments that generate better margins,” Effting said. “It’s a well-established niche, which was a focus for large banks and now has different players.”

Overall, fewer Brazilians are using savings accounts and are instead opting to put their money into securities, including tax-free products like bonds and funds linked to agriculture and real estate, the report also found. That segment grew 28% in the period.

Products similar to mortgage-backed securities known locally as LCI and CRI expanded more than 37% in the first nine months of the year, the data show.

“These are products that are profitable, secure and liquid,” Effting said. “At a moment of high interest rates, they are standing out.”

Geographically speaking, the agriculture-rich center west of the country grew the most at 12.4% in terms of investments under management, while the northeast followed with 10.2%. The southeast, which includes the states of Sao Paulo and Rio de Janeiro, is the epicenter with 3.7 trillion reais of the total.

--With assistance from Cristiane Lucchesi.