Brazil’s central bank will likely deliver its third half-point interest rate cut as bets on slowing inflation coupled with concerns over fiscal policy and the global economy support gradual easing.

All 36 analysts surveyed by Bloomberg see the benchmark Selic falling to 12.25% on Wednesday. Less than 1% of digital options traders at the local stock market expect a bigger reduction of 75 basis points, with a majority also calling for another half-point cut at December’s rate decision.

Central bankers led by Roberto Campos Neto are forging ahead with a gradual easing cycle as annual inflation is projected to slow back to their tolerance range by year’s end. At the same time, better-than-expected domestic growth is seen petering out. Still, the global outlook has turned more challenging for emerging markets as global dollar strength weighs on local currencies including the real while oil prices have risen since the start of the Israel-Hamas war.

Brazil’s decision will come hours after the Federal Reserve is expected to hold its interest rate steady, as investors assess whether another hike is still possible in the world’s largest economy.

What Bloomberg Economics Says:

“We see no compelling risk for the BCB to slow the rate cuts for now, but the rising risks - externally and domestically - may prompt it to adopt an even more cautious tone in the statement. We’ll be looking for references to the global risks, the fiscal uncertainties — especially after Lula’s remarks on the 2024 budget target — and the tight labor market.”

— Adriana Dupita, Brazil and Argentina economist

— Click here for full report

Brazil’s decision will be published on the central bank website after 6:30 p.m. in Brasilia together with a statement from its board. Here’s what to look for:

Gradual Pace

Investors will scan the statement for confirmation that Brazilian central bankers will stick with their half-point easing pace in coming policy meetings.

Campos Neto has said chances of bigger cuts are slim now, as surging US Treasury yields could reduce liquidity in emerging markets. On top of that, there are risks of even higher crude prices as the Israel-Hamas conflict worsens.

“Inflation and economic activity are going in the right direction, but the geopolitical landscape worsened,” said Caio Megale, an economist at XP Investimentos. Most analysts bet central bankers will pause their easing next September with the Selic at 9.25%. Traders see a higher terminal rate near 11%.

Any changes in forward guidance would likely encourage bets for smaller rate reductions ahead.

“They don’t have anything to win by being more or less hawkish” than at their September rate-setting meeting, said Mirella Hirakawa, economist at AZ Quest Investimentos Ltda. Previously, board members debated topics including unemployment rate and the level of slack in the economy. “I see the board converging to more agreements at this meeting,” Hirakawa said.

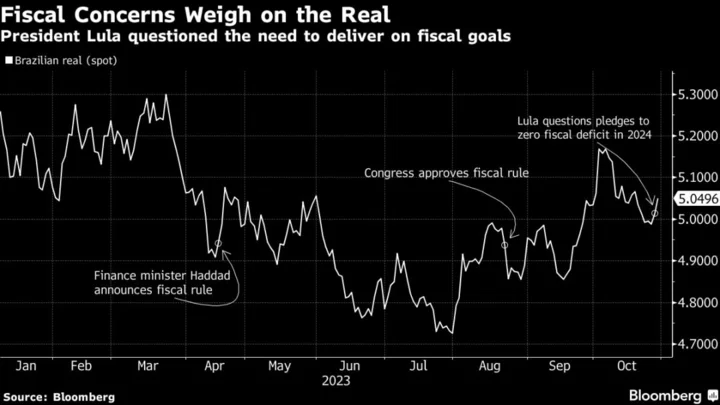

Fiscal Worries

Investors will be looking closely at any comments regarding the fiscal outlook after President Luiz Inacio Lula da Silva said his government “doesn’t need” to fulfill pledges to eliminate the budget deficit next year. Those comments are unlikely to change the bank’s short-term decisions but could enter into their balance of risks.

“We knew it was difficult to reach that goal,” said Tatiana Pinheiro, economist at Galapagos Capital Invest. “The market was already pricing that in.”

Board Members

Meanwhile, Lula has tapped economics professor Paulo Picchetti and career civil servant Rodrigo Teixeira as new board members, pending Senate approval.

They are set to replace Mauricio Moura and Fernanda Guardado, the latter of whom is considered one of the most hawkish bank policymakers. She voted for an additional rate increase in 2022 that would have taken borrowing costs to 14%, and favored a smaller initial cut this year.

Guardado, whose mandate ends in December, had a “crucial” role at the monetary authority at a time of global resilience, Cassiana Fernandez, chief Latin America economist at JPMorgan & Chase Co., said in an interview.

With the nominations, analysts will be scrutinizing the board’s tolerance for inflation even more closely. “We would expect the monetary authority to change its reactions,” Fernandez said.

--With assistance from Giovanna Serafim.