Bank of Japan Governor Kazuo Ueda received a timely reminder of the pitfalls he faces in trying to tiptoe toward policy normalization without disrupting markets.

The yen unexpectedly weakened after the central bank loosened its grip on bond yields Tuesday, as the BOJ’s move appeared to fall short of investors’ hopes for a clearer sign of progress toward policy tightening.

Still, even if Tuesday’s step was partly a stumble, it brought Japan closer to a more conventional policy approach after decades of experimentation with quantitative easing, negative interest rates and yield curve control.

“Ueda is trying to go slowly to avoid shocking financial markets,” said Takahide Kiuchi, economist at Nomura Research Institute Ltd. “Ueda says making YCC more flexible isn’t directly linked to policy normalization, but there’s no doubt that is the direction he’s heading in and he’s right to do so.”

At first glance, the move by the BOJ chief looked like a half-hearted, knee-jerk reaction to market pressure that has driven the yen to lows for the year and bond yields to their highest in a decade.

Taken in this light, Ueda’s tweak appeared aimed at allowing yields to climb more to reduce the bond-buying ammunition the BOJ must use up in defense of its strained yield curve control program. The central bank is on track to match or even outpace its record annual bond purchases of ¥119 trillion ($790 billion) in 2016, an amount seen as unsustainable at the time.

Allowing higher yields should also support the yen, thereby saving the government the job of shelling out more dollars on intervention to stop the nation’s currency from tumbling further. But the yen’s unexpected weakening on Tuesday offered a reality check on the difficulty of trying to fine-tune policy measures for a desired market response.

The currency saw its biggest one-day drop since April, sending it to a new year-to-date low and raising the risk of government action.

Ueda has taken on the daunting task of trying to dismantle the new millennium’s most ambitious experiment in monetary policy without upending global markets or wiping out the impact of more than a decade of large-scale bond purchases.

The BOJ’s rock-bottom rates have helped anchor bond yields around the world, and an abrupt removal of stimulus would put upward pressure on them. It would also risk sparking a flow of Japanese portfolio investment out of overseas markets and back home.

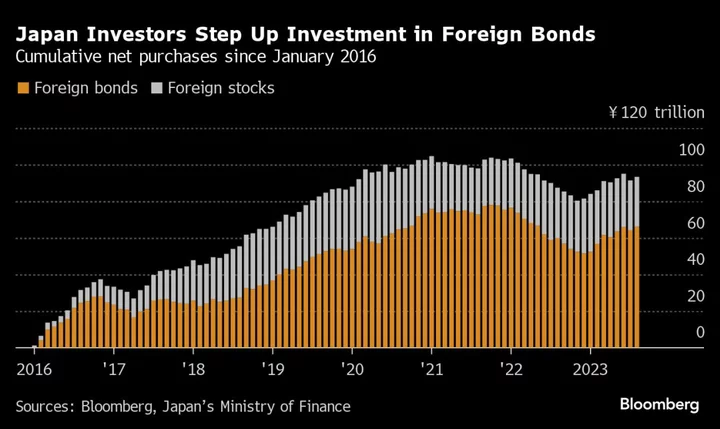

Since 2016, when the BOJ introduced its negative rate and yield curve control, Japanese investors have accumulated ¥66 trillion of foreign bonds, including those in the US, France and Australia. A further rise in local yields will threaten to trigger repatriation flows and help deepen losses in these markets.

If the 10-year yield differential narrows to about 3 percentage points between the US and Japan, that may be a level where “local investors will stay in Japan rather than taking currency risks overseas,” said Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank Ltd. “Japan is ignoring the risk of future inflation now. Should there be a sign of real yield spreads to narrow, it would have a larger impact over portfolio outflows from Japan than nominal yields.”

Paring back the BOJ’s mountain of stimulus was a task no one wanted to take on at the bank, according to people familiar with the matter. Former Deputy Governor Masayoshi Amamiya, one of the key architects of YCC, turned down the job despite strong expectations and a local media report that he was tapped for the position.

Instead the job fell to Ueda, an academic who previously spent time on the BOJ board when it introduced zero interest rates — seen at the time as a radical move. He helped engineer forward guidance on policy at the time and he voted against a premature raising of interest rates more than 20 years ago.

While that may have given the impression that Ueda is a dove, he has managed to push the BOJ along a path toward normalization at a faster pace than initially expected. He simplified guidance in April and effectively doubled the cap on yields in July.

The latest move — allowing more movements in yields without a rigid defense line — is another tweak to introduce a semblance of price-setting by market forces in a space that has been largely devoid of them. That was certainly true during the tenure of former Governor Haruhiko Kuroda as the BOJ amassed more than half of Japan’s government bonds and an asset pile that outsizes the economy in an all-out bid to stimulate the economy after decades of deflation.

The more Ueda can get rates to move in line with market fundamentals, the more likely he can pivot away from massive stimulus without large-scale ructions in markets.

‘Very Challenging Job’

“Ueda is very carefully making changes in policy little by little, and I expect that’s the only approach anyone can take as BOJ governor now,” said Ayako Fujita, chief Japan economist at JPMorgan Securities Japan. “You have to consider not only inflation, the economy and the financial system, but you also have to be aware of the potential market impact and the government’s fiscal situation. It’s a very challenging job.”

Keeping the government on his side may become an increasing challenge for Ueda as he edges closer to scrapping negative rates, a move that would push up borrowing costs for the government and homebuyers.

“Dealing with politics is the BOJ’s weakest point,” Kiuchi said. “Ueda hasn’t fully been tested on that.”

Prime Minister Fumio Kishida, whose popularity is sinking in part because of his handling of inflation, is about to unveil a fresh package of measures to further cushion the impact of higher prices on households and businesses.

Stronger growth in wages is the missing element that would enable Ueda to normalize policy and avoid a political backlash. Pay is rising at a faster pace but is still lagging inflation, driving voter discontent.

Ueda again mentioned spring wage negotiations next year as a key event for the BOJ as it assesses the wage trend. With initial results typically coming out in March, economists are pointing to April as the time Japan will likely see the end of negative rates.

--With assistance from Masaki Kondo.

(Adds more details on yen decline)