The Bank of Japan is bringing an end to its near monopoly of control over the nation’s bond market.

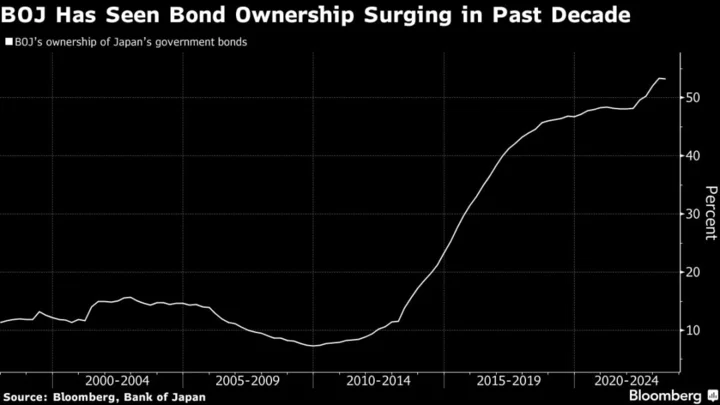

Japan’s central bank has tightly overseen the government debt market since it introduced yield-curve control in September 2016, with its ownership of outstanding bonds surpassing 50%. But with the authority now suggesting it’s ready to let the benchmark 10-year yield rise beyond 1%, investors look set to take back the helm.

It’s the third time since December that the BOJ adjusted the effective ceiling for the 10-year yield, underscoring the challenges the bank has faced in maintaining YCC. Less clear guidance will put more pressure on yields to rise, reflecting inflation in Japan that’s near a four-decade high and hawkish policy stances maintained by other major central banks.

“We can see the bigger picture that YCC is being dismantled, and that the market is back,” said Tom Nash, a portfolio manager at UBS Asset Management. “Now, 1% is no longer a hard limit requiring unlimited firepower but a reference point, so JGBs will test that level in the coming weeks.”

Signs that the central bank may be moving away from yield-curve control can be seen in its decision to stop conducting unlimited bond-purchase operations every day, and also to no longer show yield levels at which the central bank buys. The operation was initially on an ad-hoc basis until it became daily last year.

Tuesday’s decision is “a very strong signal,” Sayuri Shirai, a professor of economics at Keio University in Tokyo and a former BOJ monetary policy board member, said on Bloomberg TV. “The BOJ is not willing to purchase an unlimited amount” of bonds, she said.

Ten-year overnight-indexed swaps, which investors use to bet on or hedge against higher bond yields, trade 15 basis points above the BOJ’s 1% reference point.

The BOJ upgraded its inflation projections, saying it now expects a key price gauge to stay well above its 2% target for three consecutive years. The nation hasn’t seen such steady price growth since 1992.

The central bank’s presence still remains huge in Japan’s debt market in terms of bond purchases and an unconventional negative-rate policy. But the prospects for elevated inflation for a longer period is likely to fan speculation the BOJ will further normalize policy.

“The market is getting back at least half of its power to determine bond yields,” said Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank Ltd. in Tokyo.

--With assistance from Yasutaka Tamura.