Top US financial regulators on Friday delayed a deadline for comments on their sweeping plan to impose tighter capital rules on big banks.

The Federal Reserve, the Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency said in a joint release that they would extend the comment period to Jan. 16 from the original Nov. 30.

The Fed simultaneously announced it would push back the deadline for comments on a proposal to revise the capital surcharge for the eight largest banks. In addition, it said has started to gather data from banks affected by the proposal. Both of these deadlines are Jan. 16.

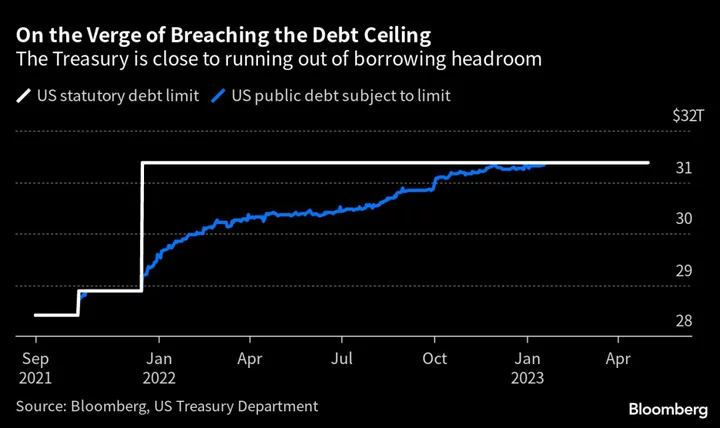

The capital mandates proposed in July set up a pitched battle with the industry over whether the regulators’ push for financial stability would make the large lenders less competitive.

Read More: Biggest Banks Face 19% Boost in Capital Mandates in US Plan

The measures would force the banks to thicken their cushions to absorb unexpected losses. Lenders with at least $100 billion in assets would have to boost the amount of capital set aside by an estimated 16%. The eight largest banks face about a 19% increase, and lenders between $100 billion and $250 billion in assets would see as little as 5% more, according to agency officials.

The plan would rope in midsize firms such as Regions Financial Corp. and KeyCorp for the kind of stringent requirements that had been reserved for the largest lenders.

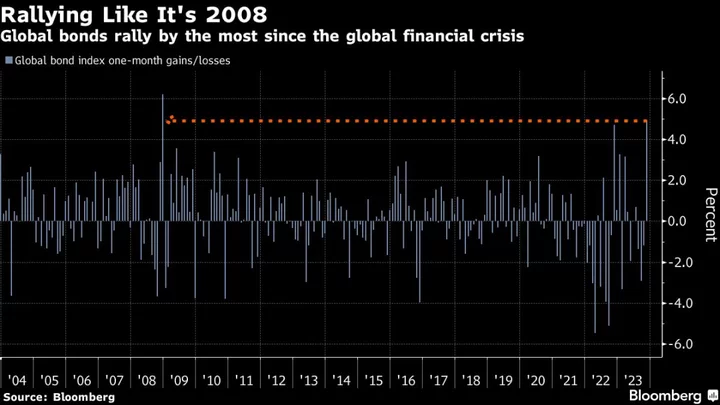

The US capital reforms are tied to Basel III, an international regulatory agreement that began more than a decade ago in response to the 2008 financial crisis. The failures of Silicon Valley Bank and Signature Bank in March, followed by First Republic Bank’s collapse in May, underscored the importance of the overhaul, regulators have said.