As big US banks earn more from lending, the question has gnawed: When will depositors see their reward? It’s finally starting.

Interest expense at Wells Fargo & Co. and JPMorgan Chase & Co. climbed a whopping 465% at each of the firms in the second quarter, the banks reported Friday. At Citigroup Inc., the firm’s executives lamented that they’re having to give both small and large customers more to stay put.

“We are, in fact, increasing what we pay out,” Citigroup Chief Financial Officer Mark Mason told reporters on a conference call. “Consumers and institutional clients are getting paid up for the deposits that they keep with us.”

The fresh look at balance sheets shows it’s not just small- and medium-sized lenders that are having to compete harder to prevent depositors from pursuing higher returns elsewhere. Months ago, big banks were swarmed with fresh deposits, when legions of customers left smaller firms and fled to the perceived safety of the largest.

QuickTake: Why Banks Are Having to Boost Their ‘Deposit Beta’

Deposits slipped at Wells Fargo and Citigroup by the end of the second quarter from the end of March, and would have been down at JPMorgan, too, if not for its takeover of First Republic Bank. The withdrawals were most evident in non-interest bearing accounts.

Expecting ‘Migration’

Some executives expect the trend to continue.

“Our core view remains modest deposit declines across the franchise,” JPMorgan CFO Jeremy Barnum told investors on a call.

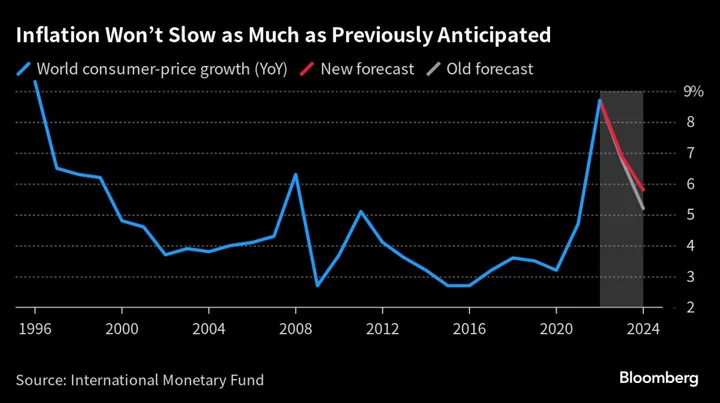

The Federal Reserve spent much of the past year aggressively raising interest rates to damp inflation. And for months, banks reaped the benefit by raising the rates they charge on loans, while showing restraint in how much they pass along to savers.

But a bevy of lenders sweetened enticements for savers during the second quarter, offering certificates of deposits and high-yield accounts with rates above 4%. That’s put pressure on the industry to compete.

For now, rewarding savers isn’t too painful for the biggest banks, because their earnings from loans is rising even faster. JPMorgan, Wells Fargo and Citigroup all raised forecasts for net interest income, reflecting the difference between what loans bring in and depositors are paid.

“We’re also assuming that we’ll see some additional outflows,” Wells Fargo CFO Michael Santomassimo told analysts on a conference call. “We’ll see some more migration from non-interest-bearing to interest-bearing deposits.”

Read more: JPMorgan’s best quarter ever shows big banks in rate sweet spot