Russia’s central bank will offload 150 billion rubles ($1.5 billion) of foreign exchange in the domestic market this month, temporarily accelerating its previously planned sales to meet some demand for hard currency from a repayment of Eurobonds.

The Bank of Russia said in a statement Wednesday it will boost almost 10-fold its daily “mirroring operations” linked to investments from the government’s wealth fund. It now plans to sell 21.4 billion rubles worth of foreign currency per day during Sept. 14-22.

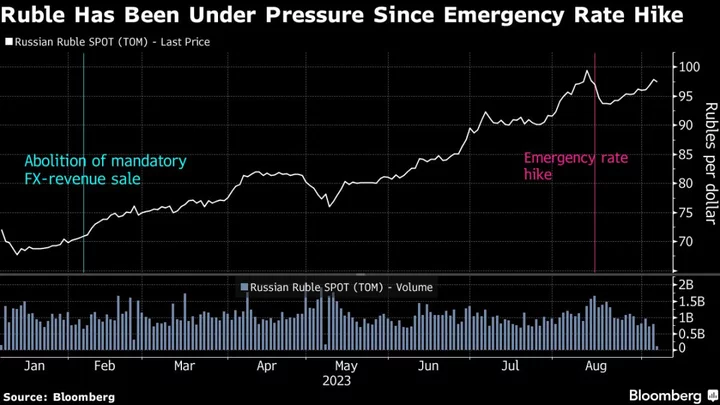

The announcement helped the ruble extend gains after it’s been depreciating in the days since an emergency meeting on interest rates in August. The Russian currency was 0.3% stronger versus the dollar as of 9:58 a.m. in Moscow.

Russia’s $3 billion Eurobond is coming due on Sept. 16, according to the central bank. Although most holders will receive a payment in rubles, it said some of them may then seek out hard currency.

“Under these conditions, the decision to redistribute foreign currency sales as part of mirroring transactions related to investing” from the National Wellbeing Fund “will help meet possible additional demand for foreign currency and reduce volatility in the foreign-exchange market during this period,” the Bank of Russia said.

As the ruble came under intense selling pressure last month, the central bank announced it would refrain from foreign-currency purchases for the rest of this year and then delivered a steep rate hike. Officials have been divided over the option of imposing curbs on the movement of capital that it used last year to stave off the ruble’s collapse after the invasion of Ukraine.

The currency is among the worst performers in emerging markets in 2023, after suffering from a deterioration in foreign trade amid a raft of international sanctions over the Kremlin’s war in Ukraine.

(Updates with ruble performance, central bank comments starting in third paragraph.)