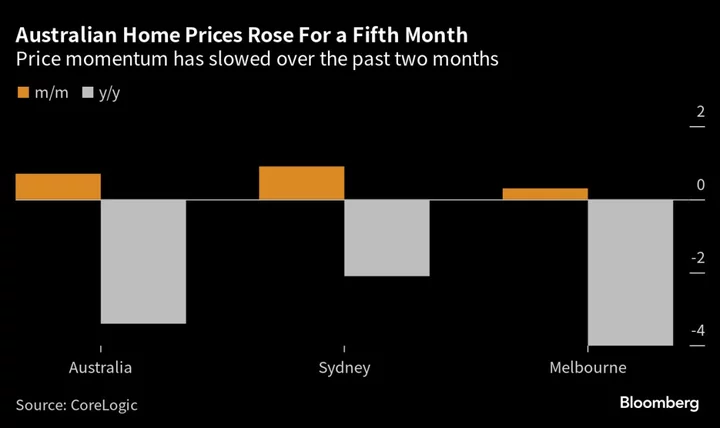

Australia’s house price growth decelerated in July following an increase in property listings that suggest sellers are taking advantage of current market strength, including those struggling to meet their obligations after rapid interest-rate increases.

Prices across Australia’s capital cities advanced 0.8%, a fifth straight monthly gain, albeit slower than June’s 1.2% pace, data from property consultancy CoreLogic Inc. showed Tuesday. Market bellwether Sydney rose 0.9% while Melbourne grew at a more subdued 0.3%.

July’s cooling was driven by the upper quartile of the market, which tends to lead the cycle and could be “a sign of a broader easing in the pace of growth over the coming months,” said Tim Lawless, research director at CoreLogic.

The figures come as the the Reserve Bank has raised its key rate to 4.1% — the highest since April 2012 — hitting consumer sentiment. At the same time, Australia’s job market remains strong, with unemployment at an ultra-low 3.5%.

The cooling in property price momentum will be welcomed by the RBA ahead of its rate decision later Tuesday. Financial markets are betting the cash rate will remain unchanged while economists see a 25 basis-point hike to 4.35%.

The central bank has lifted borrowing costs by 4 percentage points since May 2022 and signaled a higher hurdle to raise further as it tries to bring down inflation and engineer a soft landing.

Tuesday’s data showed the flow of new home listings in capital city markets rose almost 4% over July, bucking a seasonal trend in which vendors traditionally put off sales during winter months.

“It may be the case that more home owners are picking current market conditions as a good time to sell,” said Lawless. “Another possibility is that we are seeing the first signs of motivated selling as the rapid rate hiking cycle catches up with household balance sheets.”

What Bloomberg Economics Says...

“Surprise rate hikes from the RBA in May and June, and a further 25-basis-point hike we expect in August, will further erode borrowing potential, which — along with the cumulative effect of tightening through 2022 and 2023 - will weigh on the market”

— James McIntyre, economist.

Even so, the data indicate the housing rebound that began earlier this year persists — over the three months to July, prices in Sydney surged 4.5% for a median home value of A$1.08 million ($720,000).

Strong population growth in Australia and a supply shortage has fueled price gains despite higher borrowing costs.

“Overall, the housing market remains resilient to a double dip downturn, with housing values continuing to trend higher across most regions of the country,” Lawless said. “The trend in advertised stock levels will be a key factor determining housing market outcomes.”