Stocks in Asia were primed to advance after US shares hit their hottest winning streak in two years, as investors cling to hopes that interest rates have peaked.

Equity futures for Japan and Australia inched higher, while those for Hong Kong were flat. Those moves followed a 0.1% gain for the S&P 500 on Wednesday, it’s eighth consecutive advance and the best run for the index since November 2021.

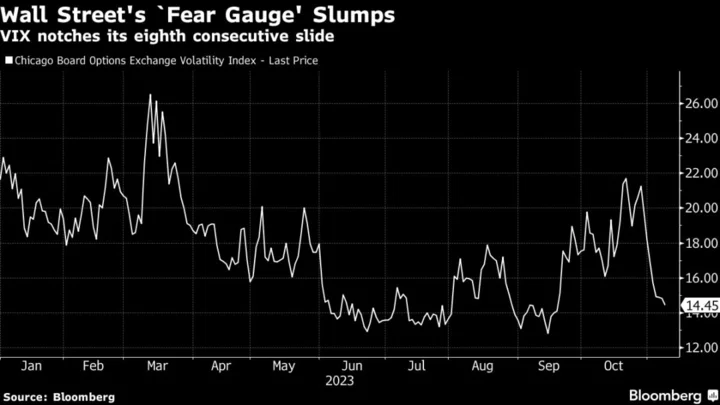

The upward momentum weighed on Wall Street’s so-called fear gauge. The VIX index marked its longest slide since October 2015 and is hovering at a level last seen in the middle of September.

Australian and New Zealand bonds climbed, mirroring Treasury moves. US ten-year yields fell eight basis points to below 4.5% Wednesday after a $40 billion auction — despite mixed metrics, which included a slightly higher-than-anticipated rate of 4.519%, signaling weaker-than-expected demand. The 30-year yield hit the lowest in over a month. Brent oil settled under $80.

The apparent calm was helped along by swaps traders pricing in almost no chance of an interest-rate increase in December, and no further hikes next year.

Those forecasts come ahead of comments from central bankers. Fed Chair Jerome Powell will appear on a panel discussing monetary policy challenges later Thursday.

“It will be interesting to hear if he makes any comments about the recent move in longer-term interest rates,” said Matt Maley at Miller Tabak + Co. “If his tone is a bit more hawkish than it was last week, it could be a catalyst for the kind of ‘breather’ in the markets we’re thinking could/should take place.”

Atlanta Fed President Raphael Bostic and his Richmond counterpart Tom Barkin are also slated to speak Thursday, as is Bank of England chief economist Huw Pill.

In Asia, Japan will release current account balance data for September and the Bank of Japan will issue October summary of opinions. Investors will be keeping a close eye on October inflation and producer prices data for China. Third-quarter gross domestic product data for the Philippines will also be released.

Brent crude slumped to below $80 a barrel for the first time since July while West Texas Intermediate, the US benchmark, slid 2.6% to below $76, a three-month low.

Corporate earnings were another factor buoying US equities. More than four in five companies within the S&P 500 that have reported results have topped estimates. Businesses outpacing profit forecasts included Walt Disney Co, which reported late Wednesday. Ride-hail company Lyft Inc. and Instacart also reported better-than-expected earnings.

Key events this week:

- Bank of Japan issues October summary of opinions, Thursday

- BOE chief economist Huw Pill speaks on the economy, Thursday

- US initial jobless claims, Thursday

- Fed Chair Jerome Powell participates in panel on monetary policy challenges, Thursday

- Atlanta Fed President Raphael Bostic and his Richmond counterpart Tom Barkin speak, Thursday

- ECB President Christine Lagarde participates in fireside chat, Friday

- US University of Michigan consumer sentiment, Friday

- Dallas Fed President Lorie Logan and her Atlanta counterpart Raphael Bostic speak, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 7:44 a.m. Tokyo time. The S&P 500 rose 0.1%

- Nasdaq 100 futures were little changed. The Nasdaq 100 rose 0.1%

- Nikkei 225 futures rose 0.6%

- Hang Seng futures were unchanged

- S&P/ASX 200 futures rose 0.4%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0708

- The Japanese yen was little changed at 150.90 per dollar

- The offshore yuan was little changed at 7.2866 per dollar

Cryptocurrencies

- Bitcoin rose 0.4% to $35,751.82

- Ether rose 0.2% to $1,890.9

Bonds

- Australia’s 10-year yield declined seven basis points to 4.51%

Commodities

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.