Asian equities look poised for a cautious open Wednesday ahead of a critical inflation report and as the US debt ceiling impasse damps investor sentiment.

Futures for benchmarks in Japan and Australia suggested small declines for those markets while contracts for Hong Kong indicated a slight gain. Futures for the S&P 500 and Nasdaq 100 opened fractionally lower in Asia after the indexes fell 0.5% and 0.7%, respectively, on Tuesday.

The US gauges have been stuck in narrow trading ranges as investors weigh the potential end of the Federal Reserve’s interest rate hikes against the possibility of an economic slowdown.

Major currencies were little changed early Wednesday after an index of dollar strength edged higher for a second day. Bond yields were steady in New Zealand following minor moves in Treasuries overnight.

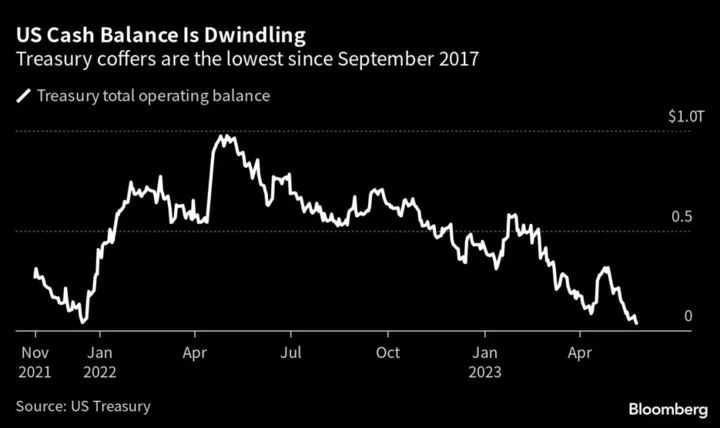

A meeting between President Joe Biden and congressional leaders provided no relief for traders seeking direction, with House Speaker Kevin McCarthy emerging from the gathering to tell reporters there was no progress in efforts to avert a first-ever US default.

That swings the focus back to inflation data, with a report later Wednesday expected to show headline CPI in the US rose by 5% in April on a year-on-year basis, indicating that price pressures are still uncomfortably high for the Fed. This will be followed on Thursday by consumer and producer price data from China, which is forecast to show easing inflation pressure in the Asian powerhouse.

The S&P 500 has been stuck trading between 3,800 and 4,200 this year. Equities could finally break out of that range and move higher if “data points more convincingly towards a soft landing, there are no more regional bank failures, core inflation drops faster than expected, the Fed confirms the pause and a debt ceiling deal is reached,” said Tom Essaye, founder of The Sevens Report newsletter.

Bears, according to Jonathan Krinsky, chief market technician at BTIG, are looking for the benchmark to fall below 3,800.

Shares of Airbnb fell postmarket after its second quarter sales outlook fell short of some analysts’ estimates, suggesting rising prices may be curbing enthusiasm for travel. Rivian Automotive Inc. climbed after the electric-vehicle maker reaffirmed its annual production plans.

Fed officials, including New York chief John Williams, are watching for signs of a credit crunch. Williams said he wasn’t including a rate cut in his forecast for this year at an event Tuesday. He left the door open on the odds of a Fed pause. Swaps suggest traders are expecting at least 50 basis points in cuts by the end of 2023.

Elsewhere in markets, oil extended its rally for a fourth day on Tuesday after the Biden administration announced plans to replenish strategic reserves. Gold rose and Bitcoin traded below $28,000.

Key events this week:

- US CPI, Wednesday

- China PPI, CPI, Thursday

- UK BOE rate decision, industrial production, GDP, Thursday

- US PPI, initial jobless claims, Thursday

- Group of Seven finance minister and central bank governors meet in Japan, Thursday

- US University of Michigan consumer sentiment, Friday

- Fed Governor Philip Jefferson and St. Louis Fed President James Bullard participate in panel discussion on monetary policy at Stanford University, Friday.

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 7:05 a.m. Tokyo time. The S&P 500 fell 0.5% Tuesday

- Nasdaq 100 futures fell 0.1%. The Nasdaq 100 fell 0.7%

- Nikkei 225 futures fell 0.1%

- Australia’s S&P/ASX 200 Index futures fell 0.3%

- Hang Seng Index futures rose 0.3%

Currencies

- The Bloomberg Dollar Spot Index rose 0.1% Tuesday

- The euro was unchanged at $1.0962

- The Japanese yen was little changed at 135.17 per dollar

- The offshore yuan was little changed at 6.9264 per dollar

- The Australian dollar was little changed at $0.6761

Cryptocurrencies

- Bitcoin fell 0.2% to $27,593.75

- Ether fell 0.4% to $1,842.89

Bonds

- The yield on 10-year Treasuries advanced one basis point to 3.52%

Commodities

- West Texas Intermediate crude fell 0.3% to $73.47 a barrel

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Peyton Forte and Cristin Flanagan.