Asian stocks were set for a mixed opening after shares in the US rebounded from their worst week since March, with Wall Street optimism offset by the latest comments from a Federal Reserve official that pointed to more rate hikes to tame inflation.

Japanese and Australian equity futures gained, while Hong Hong contracts fell. On Monday, the S&P 500 halted a four-day drop while the Dow Jones Industrial Average saw its biggest advance in more than seven weeks. Treasuries fell after Fed Governor Michelle Bowman said additional hikes “will likely be needed.”

Meanwhile, focus returned to company earnings. Berkshire Hathaway Inc. hit a record as its results beat estimates. Amazon.com Inc. rose after a news report it will meet with the Federal Trade Commission to avoid an antitrust lawsuit. Tesla Inc. slid as its chief financial officer stepped down in a surprise shakeup at Elon Musk’s company. Apple Inc. notched its longest losing streak this year.

In late trading, Beyond Meat Inc. fell as the plant-based burger company said it’s unlikely to hit its goal of becoming cash-flow positive in the second half of the year. Palantir Technologies Inc. climbed after raising its profit forecast and authorizing a $1 billion share buyback. Lucid Group Inc. gained after the maker of luxury electric sedans assured investors it’s on track to its achieve full-year production target.

In Asia on Tuesday, China and Japan are due to announce trade balance data, while Australia will release consumer confidence figures.

Meantime, Fed Bank of New York President John Williams cited the necessity to keep policy restrictive “for some time” — while noting rate cuts may be warranted next year if inflation slows. Traders also awaited the consumer price index due later this week for clues on the policy outlook.

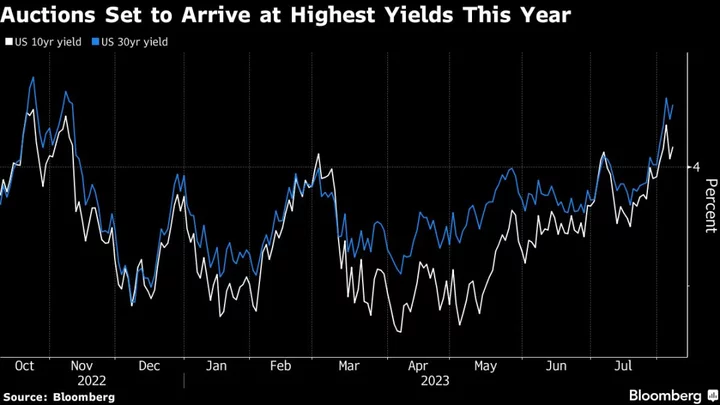

Ten-year US yields resumed an advance that drove them last week to the highest since November. Bulging sales of Treasuries are about to deliver a major test of investor demand and determine whether a selloff has room to run as the market braces for the biggest round of refunding auctions since last year. The bond market has to absorb a combined $103 billion of 3-, 10- and 30-year auctions before the week is out — up $7 billion from the May slate.

“Most of the market sees the Federal Reserve holding the fed funds rate at its current level through the rest of this year,” said Anthony Saglimbene, chief market strategist at Ameriprise. “Depending on how this week’s inflation reports come in, that forecast may see some changing odds, creating more stock volatility in the near term.”

Morgan Stanley’s Michael Wilson said that Fitch Ratings’ downgrade of US government debt last week and the ensuing selloff in the bond market suggests that “investors should be ready for potential disappointment” on economic and earnings growth.

A clear majority of investors expect a US recession before 2024 is out, leading them to view the current bull market in stocks as ephemeral and to favor long-term US Treasuries. That’s the takeaway from the latest Markets Live Pulse survey, which showed that roughly two-thirds of the 410 respondents anticipate a downturn in the world’s biggest economy by the end of next year.

Survey respondents appear to be looking past the economy’s current resilience and anticipating further damaging ripple effects from the Fed’s cumulative tightening.

“It’s important for investors to remain vigilant and not become complacent as the market’s inflation and Federal Reserve fears remain intact,” said Ryan Belanger, founder and managing principal at Claro Advisors. “Gasoline prices have been rising in recent weeks and Thursday’s CPI report may reflect that, which would boost the Fed’s arguments for remaining aggressive with policy.”

Elsewhere, wheat rose after Ukraine used sea drones to cripple a Russian naval vessel and an oil tanker over the weekend, posing a risk for a key export route for Russian commodities through the Black Sea. West Texas Intermediate traded over $82 a barrel in early Asia trading.

Key events this week:

- Japan household spending, Tuesday

- US wholesale inventories, trade, Tuesday

- Philadelphia Fed President Patrick Harker speaks, Tuesday

- China CPI, PPI, money supply, new yuan loans and aggregate financing, Wednesday

- India rate decision, Thursday

- US initial jobless claims, CPI, Thursday

- Atlanta Fed President Raphael Bostic pre-recorded remarks for employment webinar, Thursday

- UK industrial production, GDP, Friday

- US University of Michigan consumer sentiment, PPI, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 8:12 a.m. Tokyo time. The S&P 500 rose 0.9%

- Nasdaq 100 futures were little changed. The Nasdaq 100 rose 0.9%

- Nikkei 225 futures rose 0.3%

- Hang Seng futures fell 0.6%

- S&P/ASX 200 futures rose 0.4%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.1003

- The Japanese yen was little changed at 142.44 per dollar

- The offshore yuan was little changed at 7.2028 per dollar

- The Australian dollar was little changed at $0.6574

Cryptocurrencies

- Bitcoin was little changed at $29,143.8

- Ether was little changed at $1,825.06

Bonds

- The yield on 10-year Treasuries advanced five basis points to 4.09%

- Australia’s 10-year yield declined eight basis points to 4.11%

Commodities

- West Texas Intermediate crude rose 0.5% to $82.39 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.