Most Asian shares fell Monday after a mixed US jobs report and a reversal of gains on Wall Street that saw the S&P 500 lose a near 1% gain.

Benchmark indexes were lower at the open in Japan, South Korea and Australia. Futures for Hong Kong stocks slid, as did an index of US-listed Chinese stocks. The S&P 500 ended 0.5% lower Friday as Apple Inc. dropped almost 5% after its outlook sparked worries over tepid demand. By contrast, Amazon.com Inc. climbed over 8% on a bullish revenue forecast. US futures rose slightly Monday.

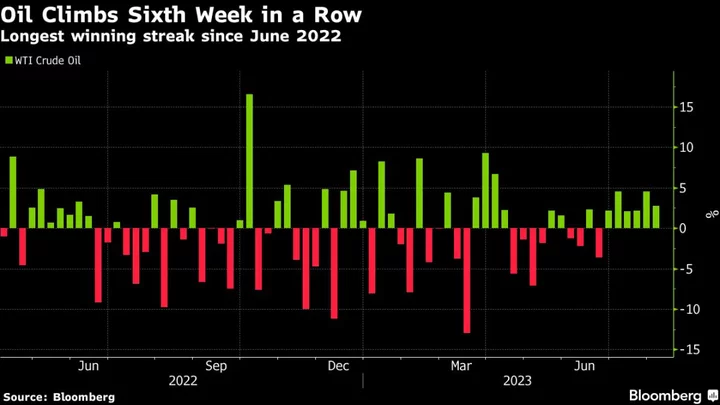

Oil held gains after Ukraine attacked another Russian vessel over the weekend, a signal of a rapidly expanding war that puts at risk significant flows of Russia’s commodities from the Black Sea.

The greenback was locked in narrow ranges versus most of its Group-of-10 counterparts as the trading week got underway. The US currency slid Friday amid a debate among Federal Reserve officials on whether additional interest-rate hikes are needed.

The yen was little changed around 141.7 to the dollar after strengthening about 0.6% Friday. A summary of opinions from the Bank of Japan’s July meeting showed that one member said adjusting the yield-curve control has inherent difficulties.

Treasuries yields edged higher in early trading hours in Asia, reversing some of Friday’s declines after the jobs report with 10-year yields falling from the highest level since November.

Mixed Data

There was something for every bull and bear in the jobs data: the 187,000 growth in payrolls was softer than estimated, wages topped forecasts and unemployment fell.

Swap traders projected about a 40% chance of another quarter-point rate increase by the Federal Reserve by the end of this year. By the end of 2024, they projected rate cuts totaling more than 125 basis points.

Fed officials Raphael Bostic and Austan Goolsbee suggested that slower US employment gains mean the central bank may soon need to pivot to thinking about how long to hold rates at elevated levels. Their colleague Michelle Bowman said the Fed may need to raise rates further in order to fully restore price stability.

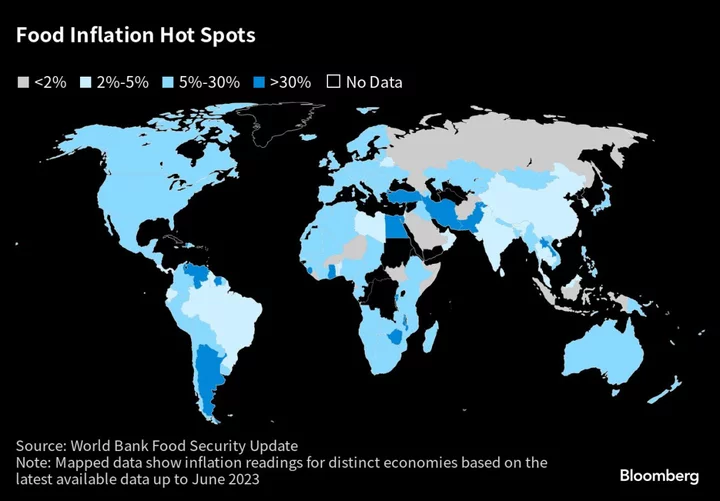

However, Fed doves may be too confident about the strength of the US economy and an easing in price pressures, according to Win Thin, head of currency strategy at Brown Brothers Harriman & Co. “As we’ve pointed out before, the easy part is getting from 8% to 4%; the hard part is getting it from 4% to 2%,” he said about US inflation in a note. “Because of this, we believe the markets continue to underestimate the Fed’s capacity to tighten.”

Elsewhere in markets, gold was little changed.

Key events this week:

- Atlanta Fed President Raphael Bostic and Fed Governor Michelle Bowman at Fed Listens event, Monday

- Bank of Japan issues Summary of Opinions for July monetary policy meeting, Monday

- Japan household spending, Tuesday

- US wholesale inventories, trade, Tuesday

- Philadelphia Fed President Patrick Harker speaks, Tuesday

- China CPI, PPI, Wednesday

- India rate decision, Thursday

- US initial jobless claims, CPI, Thursday

- Atlanta Fed President Raphael Bostic pre-recorded remarks for employment webinar, Thursday

- UK industrial production, GDP, Friday

- US University of Michigan consumer sentiment, PPI, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.3% as of 9:13 a.m. Tokyo time. The S&P 500 fell 0.5% Friday

- Nasdaq 100 futures rose 0.4%. The Nasdaq 100 fell 0.5%

- Japan’s Topix index fell 0.4%

- Australia’s S&P/ASX 200 Index fell 0.1%

- Hong Kong’s Hang Seng futures fell 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.1009

- The Japanese yen was little changed at 141.72 per dollar

- The offshore yuan was little changed at 7.1866 per dollar

- The Australian dollar rose 0.1% to $0.6579

Cryptocurrencies

- Bitcoin fell 0.2% to $29,044.01

- Ether was little changed at $1,828.49

Bonds

- The yield on 10-year Treasuries advanced one basis point to 4.05%

- Japan’s 10-year yield declined 1.5 basis points to 0.625%

Commodities

- West Texas Intermediate crude rose 0.2% to $82.95 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.