Asian stocks are set for a weak open after US equities and Treasuries fell following disappointing tech earnings and fresh signs of labor-market resiliency that could support another hike in interest rates this year.

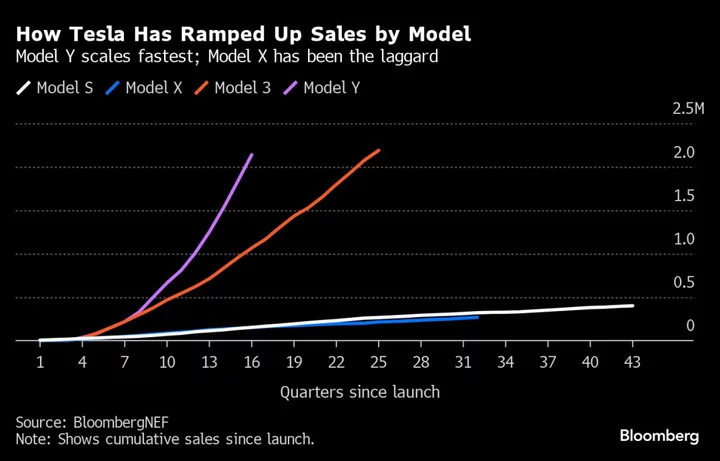

Equity futures for Japan and Hong Kong posted modest losses, while contracts for Australia were little changed. The tech-heavy Nasdaq 100 scored its biggest drop in nearly five months, as Netflix Inc. fell on a disappointing revenue forecast and Tesla Inc. slid after profitability shrank in the second quarter.

Meanwhile, an unexpected drop in weekly initial jobless claims prompted traders to price in higher odds of a quarter-point rate hike beyond the Federal Reserve’s meeting next week, boosting the dollar and yields on 10-year Treasuries.

The declines are hitting the pause button on this year’s blistering stock rally that’s seen the S&P 500 rise 18%, and the Nasdaq 100 gain 41%, against a shaky economic outlook during the Fed’s aggressive tightening campaign.

The returns on the back of a handful of tech stocks are “overdone” and may be the precursor to a downturn, Aegon Asset Management strategist Cameron McCrimmon said. The sentiment was echoed by Louise Goudy Willmering, a partner at Crewe Advisors.

“To be just driven simply by a few names in technology is not great,” Goudy Willmering said by phone. “Earnings will definitely determine where we go from here as we look into the third and fourth quarters.”

The Bloomberg Commodity Index is set for its third weekly gain, following a surge in wheat prices after an escalation of tensions between Russia and Ukraine in the Black Sea. Natural gas futures in Europe and the US are also set to notch near 10% gains this week as extreme heat boosts power demand for air conditioning. Oil edged up on Thursday as liquidity dwindles while gold retreated from a two-month high on the strengthening dollar.

“In the last 24 hours alone there has been talk of a worsening of the conflict in Ukraine, a further slowdown in China and major US banks facing significant real estate losses,” Lewis Grant, senior portfolio manager at Federated Hermes, wrote in a note. “Each of these threats, along with uncountable unknowns, has the potential to halt the sentiment rebound in its tracks.”

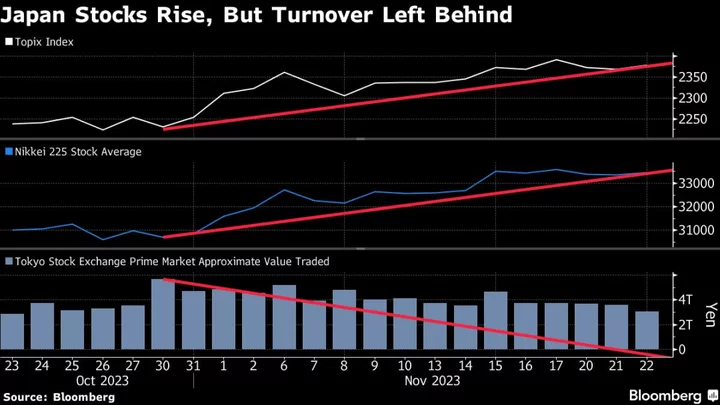

In Japan, traders will focus on inflation data on Friday, the next potential catalyst for speculation about looming monetary policy tweaks that would bump up yields. The 10-year bond yield has edged up toward the Bank of Japan’s 0.5% ceiling, while the yen has pared its recent weakness against the dollar.

Key events this week:

- Japan CPI, Friday

Some of the main moves in markets:

Stocks

- Hang Seng futures fell 0.1% as of 7:19 a.m. Tokyo time

- Nikkei 225 futures fell 0.3%

- S&P/ASX 200 futures were little changed

- The S&P 500 fell 0.7%

- The Nasdaq 100 fell 2.3%

Currencies

- The Bloomberg Dollar Spot Index rose 0.4%

- The euro was little changed at $1.1135

- The yen was little changed at 140.04 per dollar

- The offshore yuan was little changed at 7.1758 per dollar

Cryptocurrencies

- Bitcoin rose 0.3% to $29,840.71

- Ether rose 0.4% to $1,896.37

Bonds

- The yield on 10-year Treasuries advanced 10 basis points to 3.85%

Commodities

- West Texas Intermediate crude rose 0.2% to $75.77 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.Currencies

--With assistance from Cecile Gutscher and Isabelle Lee.